The seriousness of its development intent can be seen by the recent appointment of Ron Hochstein as chair of its board of directors.

Hochstein is president and CEO of Lundin Gold and steered that company through the permitting, construction and commencement of operations of the Fruta del Norte gold mine in Ecuador, and will provide invaluable support to president and CEO David Cates as Denison advances towards development.

ISR currently accounts for over half of the world's uranium production, but none so far in Canada's Athabasca Basin.

"ISR mining requires a certain geologic setting. It requires permeability, the ability to move solution through the host rock. It requires leachability to dissolve the uranium, and it requires containment to control the solution you put into the ground," said Cates.

"Typically, you have a confining layer, like clay, above and below the deposit with the sandstone, which hosts the uranium being the meat in the sandwich."

Uranium deposits in the Athabasca Basin typically don't have all of those conditions.

At Wheeler River's high-grade Phoenix deposit, Denison has highly leachable uranium ore in permeable sandstone, plus impermeable basement rocks below the deposit, and has turned to technology to offer containment in the absence of an aquitard above.

"We studied the concept of using ground-freezing technology and directional drilling to create an inground ‘dome' over the top and sides of the deposit as part of our 2018 PFS," said Cates.

"Ground freezing technology uses a chilling brine that is circulated through cased drill holes, which reduces the ground temperature below zero to gradually freeze the waterisaturated sandstone surrounding the deposit - effectively creating a physical ‘ice wall' to contain the ISR mining activity. This was the breakthrough concept that made the idea of ISR mining in the Athabasca feasible."

Subsequent testwork showed that solutions injected into the ISR wellfield at the ore-zone depth (~400m) do not travel upwards and so Phoenix is not expected to require a containment layer above the deposit.

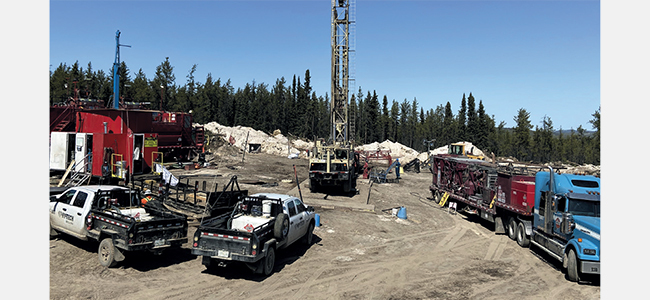

Denison Mines' Wheeler River project, where commercial-scale well coring and well development activities are running simultaneously as part of 2021 Phoenix ISR field test

"We recently changed our design to a staged fence/wall layout, rather than the previously designed ‘dome', using the same ground freezing approach, but lower-cost and lower-risk vertical diamond drill holes to create a series of phased cylindrical perimeter walls that extends from the surface down to the basement rock - which creates contained zones akin to a very large in-ground leach vessel similar in concept to those used on surface in a conventional mill," said Cates.

The road towards development will see Denison undertake a commercial-scale test pattern of five test wells (and multiple monitoring wells) at Phoenix this year. The test will usetracer elements to map out the solution flow and identify how it permeates within and outside the pattern.

The deposit hosts very high grades that average over 19% U3O8, including a high-grade core that is estimated to average over 40% U3O8. Denison will use the results from the 2021 test to refine its modelling and support the permitting process to run a live leach test in 2022.

"If we can recover uranium-bearing solution from a commercial well field test in 2022, we will have truly derisked the project to the maximum extent possible prior to commercial operation," said Cates.

Success could have a dramatic impact on future project developments in the Athabasca Basin, given the ISR method's low initial capital and operating costs compared with traditionally used extraction and processing techniques.

A 2018 prefeasibility study (PFS) on the Phoenix deposit estimated all-in costs of US$8.90 per pound of U3O8, which would mean the operation is quite profitable using the Denison's base-case price assumption, which has first production sold in the range of $29/lb U3O8. This is just below current market prices, whereas several world-class operations, such as Cameco's McArthur River, are currently mothballed at these price levels.

"Advancement of Phoenix is not reliant on an improving uranium market, as our base case for Phoenix features a US$29/lb U3O8 selling price, which is lower than today's spot price," said Cates.

"In the long-run, we could be looking at a new wave of mining in the Athabasca Basin that competes with the cost profile of ISR mining operations in Kazakhstan, rather than massive operations that are reliant on scale and susceptible to the market ups and downs."

The ISR approach also promises to deliver environmental and social benefits that are likely to be of increasing importance for permitting and financing the development of Phoenix.

The project would not generate any conventional tailings or wasterock stockpiles, removing community concerns over the possibility of future contamination. Not having an open pit or shaft also means the operation would not rely on heavy equipment and could have very low carbon dioxide emissions.

"Wheeler River is situated close to the provincial power grid, which is energised in the north by hydropower, so we have the potential to generate a very low CO2 footprint. We are looking at electrifying as much as possible on site, potentially even the drills," said Cates.

‘Advancement of Phoenix is not reliant on an improving uranium market'

- DAVID CATES

PRESIDENT AND CEO

With investors rapidly warming to the promise of a reinvigorated uranium market, on the back of a resurgence of nuclear power as part of the global clean energy transition, Denison took the strategic decision to spend US$74 million in April to buy 2.5Mlb of U3O8 to bolster its balance sheet and provide a future source of collateral to be used when financing the estimated C$322.5 million initial capital cost of Phoenix.

This acquisition followed a series of equity financings that have positioned Denison to fund the advancement of Phoenix.

"Through February, we raised all the money we need to get through permitting and feasibility and into early project procurement, but we didn't think it would be wise to raise an additional C$100M and just put it on our balance sheet earning little to no return as cash," said Cates.

"With our subsequent financing in April, our strategy was to take advantage of the deep institutional investor interest in Denison and the sector by issuing additional equity and parking that capital in physical uranium holdings, instead of cash, which will share a similar leverage to rising uranium prices as our existing mining assets."

"Rather than simply sell it down the road, potentially at a higher price, to generate cash to fund a portion of project construction, we will first look to borrow against our uranium holdings, to lower our overall cost of capital and reduce the extent of future equity dilution.

"Once the project debts are repaid, we would then sell the uranium holdings to our customers alongside future uranium production from Phoenix. Our research analysts loved this approach and increased their target prices for Denison."

Another strategic decision the company made recently was an unsolicited bid for the 10% of Wheeler River it doesn't already own, among other uranium strategic assets in Canada, for C$41 million via the purchase of JCU (Canada) Exploration Company Ltd (JCU), from Overseas Uranium Resources Development (OURD).

In addition to Wheeler River, JCU holds interests in various early-stage uranium assets in the Athabasca Basin plus a 31% interest in Cameco's Millennium project, and a 33.8% interest in Orano's Kiggavik project in the Nunavut.

Denison's bid came after UEX Corporation announced an agreement to acquire JCU for C$12.5 million in April. In late June, Denison and UEX decided to team-up and announced that UEX amended its agreement with OURD to increase the purchase price for JCU to C$41 million, while also agreeing to sell 50% of JCU to Denison, immediately on closing of the purchase of JCU from OURD, for C$20.5 million. As a result, Denison and UEX will co-own JCU, meaning that Denison will effectively own 95% of its flagship Wheeler River project.

With uranium prices starting to tick higher on the back of a growing supply deficit, the timing for Denison Mines to enter production in the coming years could not be better.

ABOUT THIS COMPANY

Denison Mines

Denison is a uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada.

HEAD OFFICE:

- 1100 - 40 University Avenue, Toronto, ON, Canada, M5J 1T1

- Tel: +1 416 979 1991

- Web: www.denisonmines.com/

- Email: info@denisonmines.com

SOCIAL MEDIA:

DIRECTORS:

- Ron Hochstein

- David Cates

- Robert Dengler

- Brian Edgar

- Jun Gon Kim

- David Neuburger

- Jennifer Traub

- Patricia Volker

MARKET CAPITALISATION:

- C$1,300 million (as of June 29)

QUOTED SHARES ON ISSUE:

- 805 million