Mining was a key interest of George Laird Shoup, who was appointed governor of Idaho Territory in 1889 and who oversaw its admission into the Union in 1890 when he was elected Idaho's first governor. Shoup was a mining prospector who had claims in the Salmon area which passed down to his descendants including the Arnett claim now under exploration by Revival Gold.

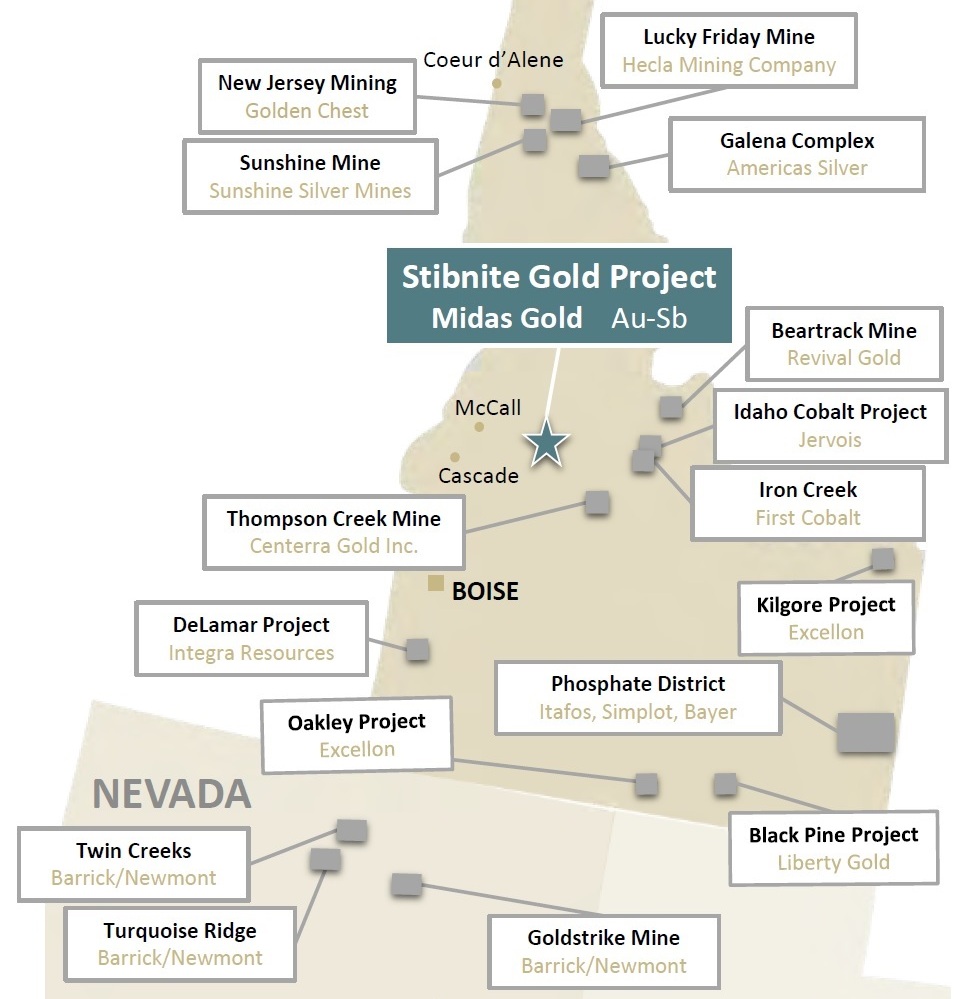

Idaho is emerging from the shadows of neighbouring Nevada and becoming a focus for gold exploration as the state seeks to re-establish one of the key industries of its past.

Investors are increasingly getting the message.

Figures compiled by BMO and Revival Gold (below) show some C$211 million has been raised for companies with projects in Idaho so far this year, more than double the $90 million raised in 2019. Given the $64 million raised for Americas Gold and Silver is mainly for its operations in Nevada, the figure is still $147 million. And with Integra Resources undertaking a US$20 million bought deal as this article goes to press, that figure continues to tick upwards.

The potential of the state has attracted one of the world's largest hedge funds in the shape of Paulson & Co, which in August announced the exercise of some C$82.1 million-worth of convertible notes to take a 44.1% stake in Midas Gold.

|

Date

|

Company

|

Amount (C$M)

|

|

Sep-20

|

Integra Resources

|

$26.3

|

|

Aug-20

|

Midas Gold

|

$82.1

|

|

Aug-20

|

Americas Gold and Silver

|

$35.0

|

|

Jul-20

|

Bunker Hill Mining

|

$20.4

|

|

Jul-20

|

Revival Gold

|

$15.1

|

|

Jul-20

|

Idaho Champion

|

$8.1

|

|

Jun-20

|

Freeman Gold

|

$10.4

|

|

May-20

|

Phoenix Copper

|

$3.0

|

|

May-20

|

Americas Gold and Silver

|

$28.8

|

|

Mar-20

|

Revival Gold

|

$1.0

|

|

Feb-20

|

Phoenix Copper

|

$2.0

|

|

Jan-20

|

Bunker Hill Mining

|

$4.0

|

|

Jan-20

|

Idaho Champion

|

$1.2

|

|

Nov-19

|

Integra Resources

|

$25.3

|

|

Aug-19

|

Otis Gold Corp

|

$1.3

|

|

Aug-19

|

Liberty Gold

|

$15.8

|

|

Jul-19

|

Bunker Hill Mining

|

$1.6

|

|

Jun-19

|

Jervois Mining

|

$15.1

|

|

Jun-19

|

Bunker Hill Mining

|

$1.7

|

|

Jun-19

|

Midas Gold

|

$19.9

|

|

May-19

|

Phoenix Copper

|

$1.2

|

|

May-19

|

Hawkstone Mining

|

$2.2

|

|

Feb-19

|

Revival Gold

|

$5.0

|

|

Feb-19

|

Phoenix Copper

|

$1.6

|

Source: BMO, Revival Gold

Idaho presented early-movers with the opportunity to pick up prospective properties without the competition crush seen in Nevada to the south but with similar geological attractions. "Carlin-style sediment-hosted deposits occur in [Nevada, Idaho and Utah] and they all have the same permitting procedures with the BLM and Forest Service," Cal Everett, president and CEO of Liberty Gold, told Mining Journal.

Liberty acquired its Black Pine project in June 2016 for US$800,000 cash, 300,000 shares and a 0.5% NSR. "The relatively low profile of Idaho as an exploration jurisdiction has enabled Liberty to increase its land package four times as it has made discoveries with no-one else staking around it," said Everett.

"There was a rejuvenation of gold exploration in Nevada following the late 1990s crash and 2000s recovery. Nevada picked-up pretty rapidly, but Idaho was passed over. Midas saw an opportunity in former gold mines and prospects that were not being picked-up," Stephen Quin, president and CEO of Midas Gold, told Mining Journal.

Revival Gold and Integra Resources have similar stories related to their respective Beartrack-Arnett and DeLamar projects.

"Up until five years ago, the Idaho Mining Association (IMA) was primarily focused on operators, but with the new growth in gold exploration and other critical minerals we have seen substantial growth in the exploration and development side of our membership. We have increased from four or five exploration companies to 10-to-15. Word has gotten out that have great geological resources, friendly state policy makers and that the jurisdiction is good," association president Ben Davenport told Mining Journal.

Drilling contractor Boart Longyear has seen exploration activity pick up in the state and has increased its fleet of drills. "The IMA has done a good job of lobbying for the importance of mining in the state. We have seen a lot of gold exploration going on with Integra Resources, Revival Gold, Midas Gold and probably 20 other companies who have picked up projects. There has not been as much exploration activity in Idaho in the last 25 years as we have seen right now," Thomas Feehan, business development and commercial manager, told Mining Journal.

New approach, new relations

The return of gold exploration and development to Idaho has been fostered by the transparent and collaborative approach adopted by the early movers, which they saw successfully deployed in Yukon, Canada. "No mine had been built in the Yukon for 10-15 years and the projects were struggling to move forward. We got the industry working together and got the local government on board to collectively tell the story, which helped change attitudes. Through the Yukon Mining Alliance, this has developed into a continuous and sustained effort," said Quin.

Hugh Agro, president and CEO of Revival Gold, experienced the Yukon collaboration when he worked there with Kinross Gold. Later, as a director of Americas Gold and Silver—which operates the Galena mine in northern Idaho—he renewed contact with Quinn.

"We talked about how what one party does in the state has an impact on the others and therefore there is a need to operate to the highest standards and take our stewardship seriously. This has guided the approach of Revival at Beartrack-Arnett and the spirit of keeping the bar high continued when Integra announced its transaction to pick up Delamar as George Salamis has the same ethos of working together to a high standard," he told Mining Journal.

The welcome reception gold explorers have received from state officials stems from this approach as it enables them to get behind the ultimate benefits of rural development rather than running the political gauntlet of supporting the mining sector per se. On this basis, state politicians have contributed to investor outreach with former governor Butch Otter and current governor Brad Little both having participated in investor seminars in New York, Toronto and other cities.

"The state government wants to see job creation and economic activity come to rural parts of Idaho for the betterment of the communities just as it has come to urban parts. Governor Little understands that in the far-flung parts of the state the industries that are available are tied to the land, which means supporting responsible exploration and mining activity," said Agro.

Mining represented about $1 billion in GDP for the state, according to a 2016 study prepared with the IMA and with a population of less than 2 million people, the economic impact of a mining project can make a massive difference, particularly as the past mining history enables much of the economic impact to accrue within the state.

"There is a strong talent pool to go with the great geology in Idaho. There is a rich history of mining and exploration so there is a lot of human resource talent and professional capability which can be brought to bear on projects. There is an on-shoring trend in the USA that the mining industry is part of and can take advantage of by coming to underappreciated and overlooked regions. Our GM, Pete Blakely, lives in Salmon and was the former GM for the Beartrack operation for Meridian Gold. We didn't have to fly a team in from Canada, which is a huge differentiator," said Agro.

Former operators such as Meridian and Kinross completed full mine reclamation projects at Beartrack and DeLamar and also invested in education, which offered opportunities for people in rural areas to learn trades and pursue higher education, a legacy which is remembered. "When we sit with local officials, they remember when mining and exploration in Salmon helped support a vibrant community with jobs, investment, education and support for local hospitals and businesses," said Agro.

Stibnite in Idaho, USA

Stibnite

Midas Gold was the first mover in the current Idaho gold chapter.

At the Stibnite former gold, silver, antimony and tungsten mine, it saw the possibility of making positive economic, social and environmental impacts with a brownfield project which had not been fully remediated, with a potential prize worth the effort of taking on greater responsibility than companies typically do. Stibnite will produce more than 337,000 ounces a year, making it one of the five biggest gold mines in the USA. With a draft environmental impact study (DEIS) published in August and a record of decision potentially coming in about one year's time, it is trailblazing the permitting process for other companies.

"We pioneered getting Idaho on the radar with a very different approach: a brownfield project with significant unremediated environmental issues," Quin said.

"Before filing our permit applications in 2016 we spent about five years designing a plan with a synergistic relation between remediation of legacy impacts and project economics. Standard reclamation as required by law was not our goal but to restore the site to create a fully-functioning ecosystem."

A 2014 pre-feasibility study on Stibnite, amended in 2019, pegged the initial capex outlay at US$1.25 with an all-in sustaining cost of $506/oz and an initial 12-year mine life. In addition to developing a modern gold mine it will fund the reclamation and restoration of numerous legacy impacts including restoring passage for various fish species including Chinook salmon to the headwaters of the Salmon River for the first time in 80 years.

A significant amount of Idaho land is controlled by the federal government either via the Bureau of Land Management or the US Forest Service, which means the permitting framework is NEPA (National Environmental Policy Act), with participation from the Environmental Protection Agency and US Army Corp of Engineers. A key element for Midas has been the cooperation of the federal and state agencies in the permitting process. In August, the US Forest Service released a DEIS on Stibnite for public comment with 60 days for individuals to comment on the proposed redevelopment and restoration.

"There is a coordinated permitting effort between the federal agencies, but we went beyond that with the Idaho Joint Review process, and was triggered by the governor, which also incorporates state agencies," Quin said.

"We have seven federal, state and county agencies cooperating to ensure the process meets all their requirements. We are like the person walking through a 4ft snowdrift who does the heavy work and breaks the trail for the others coming behind. Other companies will benefit from the solutions we found to the challenges we ran into."

"We are glad to see that first step on the regulatory front for Stibnite and that it is under comment and review," Davenport said.

"Midas Gold getting across the finishing line with a favourable record of decision tells a story to investors and the rest of the industry that Idaho can get it done."

Revival's Agro said: "The industry is keenly watching Midas' progress as it will be a bellwether on the state and federal governments willingness to support responsible mining and exploration in the state."

Integra Resources is taking a similarly open and cooperate approach having signed a memorandum of understanding (MOU) in August with the US Bureau of Land Management to facilitate the hiring of a dedicated mineral specialist in the local BLM office to oversee future permitting of DeLamar.

The MOU streamlines the permitting process, allowing for an efficient communication framework with the ability to have initial plans reviewed for accuracy and conditionally approved by various regulatory agencies up front.

After Stibnite, Integra is moving DeLamar towards pre-feasibility after a September 2019 PEA outlined a 27,000tpd heap leach operation complemented by a 2,000tpd milling facility with annual production of 103,000oz of gold and 1.7Moz of silver for a 10-year mine life following an initial capital expenditure of C$213 million. The DeLamar and Florida Mountain deposits host measured and indicated resources of 172.4Mt grading 0.43g/t gold and 21g/t silver, containing 2.4Moz gold and 116.5Moz silver.

Revival Gold will be the next company to post economics with a PEA on its gold-only Beartrack-Arnett project due before year end.

It plans a two-phased approach of an initial openpit heap leach project to be followed by a mill development. Beartrack-Arnett is the largest past-producing gold mine in Idaho and hosts one of the highest-grade gold deposits in the state. It hosts an indicated mineral resource of 36.4Mt grading 1.16g/t containing 1.35Moz and an inferred resource of 47.2Mt grading 1.08g/t containing 1.64Moz.

In August, Revival doubled its planned drilling programme from 5,000m to 10,000m to include four target areas for resource expansion and infill drilling. At Beartrack, drilling will help establish the scale of the mineralised system beyond its current 5.6km strike with targets 2km and 3km from the existing mineral resource. "Revival has ramped up to complete the biggest exploration programme to be undertaken at Beartrack-Arnett since the 1990s," Agro said.

"We will test several potential game-changing targets on the project."

Black Pine in Idaho, USA

An economic study on Black Pine is still some way into the future as Liberty Gold first plans to produce an initial mineral resource estimate in the first quarter of 2021 and then keep drilling until it has determined the dimensions of the orebody.

A geological reinterpretation opened the door to bigger possibilities as it identified that gold deposition is stratigraphically-controlled with higher grades to be found below the depth of historical drilling. The company has made discoveries roughly outlining a 1.4km long high-grade area within 6-7km of regional potential. Recent drilling results include 80.8m grading 0.98g/t in the D3 zone including 18.3m grading 2.32g/t.

"In 2013, Moira Smith visited Black Pine and recognised it was a Carlin-style sedimentary hosted deposit which hadn't been interpreted correctly," said Everett.

"She thought the five pits that were previously mined were the same system. The previous owner didn't drill deep enough. When I joined the company in 2016 I asked her if there was anything she wanted and she said, Black Pine. This is not going to be a 1-3g/t deposit as there is a mass of 0.5g/t material around it. The deposit average grade is going to be below 1g/t. We want a minimum 2Moz resource at a 0.5g/t cut-off but will keep drilling to delimit the orebody."

Initial metallurgical testing shows Black Pine has all the makings of becoming a very profitable mine as even at sub 1g/t, the resource would still be considerably higher grade than oxide deposits currently exploited in Nevada. Bulk sampling showed 78.9% to 92.8% recovery with higher recovery from higher grade material. "SSR Mining's Marigold project is really low grade but ultra-high margin rock. Every sample there has detectable gold the same as at Black Pine," said Everett.

With explorers prospering and advancing projects in Idaho, the majors have gradually taken notice. Barrick Gold has an 11.3% interest in Midas Gold via investments in May 2018 and June 2019. Agnico Eagle Mines acquired an interest in Otis Gold in February 2017, which was exploring the Kilgore project, which turned into an interest in Excellon Resources following its February 2020 acquisition of Otis.

And perhaps the most symbolic was Coeur Mining's November 2019 investment in Integra Resources, which marked a return to Idaho for a company known as Coeur d'Alene Mines until 2013, which has a long history operating in the northern part of the state where silver has been mined continuously for 125 years.

"There were not that many major miners looking at Idaho as they were all focused on Nevada, but I think that is about to change. It is logical there would be corporate interest with significant drill intercepts, at multiples of what is mined in Nevada in terms of grade," said Everett.

|

Company

|

Project

|

Stage

|

Production oz/y

|

AISC

|

Capex

|

Resource

|

Strategic

|

|

Midas Gold

|

Stibnite

|

FS late 2020 PFS Dec 2014

|

337,000

|

$568/oz

|

US$970M

|

4.6Moz P&P @ 1.5g/t

|

Barrick Gold

|

|

Integra Resources

|

DeLamar

|

PEA Sep 2019

|

124,000

|

$619/oz

|

C$213M

|

3.9Moz AuEq @ 0.7g/t M&I & 501koz AuEq @ 0.55g/t Inf

|

Coeur Mining

|

|

Revival Gold

|

Beartrack-Arnett

|

PEA pending 4Q20

|

N/A

|

N/A

|

N/A

|

1.35Moz @ 1.16g/t Ind & 1.64Moz @ 1.08g/t Inf

|

N/A

|

|

Liberty Gold

|

Black Pine

|

Resource drilling

|

N/A

|

N/A

|

N/A

|

Pending 1Q21

|

Newmont Mining

|

|

Excellon Resources

|

Kilgore

|

PEA 2019

|

111,700

|

$832

|

$81

|

44.6Mt @ 0.58g/t Ind & 9.4Mt @ 0.45g/t Inf

|

Agnico Eagle Mines

|

TOPICS:

- Hugh Agro

- Stephen Quin

- Cal Everett

- Benjamin Davenport

- Black Pine

- Stibnite

- Arnett-Beartrack

- DeLamar

- Galena

- Idaho Mining Association

- Governor Butch Otter

- Brad Little

- Marigold

- Gold

- Silver

- United States

- Canada

- Revival Gold

- Integra Resources

- Midas Gold

- Excellon Resources

- Otis Gold

- Liberty Gold

- Coeur Mining

- Barrick Gold Corporation

- Agnico Eagle Mines

- Americas Gold and Silver Corp

- Kinross Gold

- Boart Longyear

- SSR Mining