Highfield Resources is developing one of the world's lowest-cost, highest-margin potash mines in northern Spain's Ebro Basin, and at long last, all the signs indicate the company is ready to take-off.

There have been a few false dawns in the past around when construction can begin, but Ignacio Salazar, who was appointed CEO last July, gives the impression of a man with a spring in his step.

"All the answers to the final section of the documentation for the mining concession are signed, sealed and delivered to the authorities. And the omens look good," he said.

"There have been no red flags, and we think we'll get the green light in the first half of this year. Hopefully earlier, perhaps in a matter of weeks. And then we could start construction in the second half."

In the past, permitting issues have dogged Highfield. There were years of stop-start negotiations with regional and environmental bodies.

But if all goes well, the timing couldn't be better as prices for agricultural commodities are hitting multi-years highs. What better time to seek decent terms for debt financing from lenders who must carefully manage risk.

The capital cost of Muga phase one is forecast at €370 million to produce 500,000 tons per year of muriate of potash (MOP). Further down the line, phase two would double output to 1 million tonnes.

Since the beginning of 2021, potash prices, along with those of fertilisers and crops in general, have been increasing strongly, driven by a resurgence of demand, especially from China where the state is rebuilding inventories at a rapid pace to attain food security.

Demand in Europe is also on the rise, albeit more slowly than in the Americas and Asia, but Highfield's share price has reacted positively as investors sense the tide is turning - the shares are 25% to the good since November.

Two developments have spurred confidence. An independent study of Muga from the government of Navarra concluded in early March that the mine represented significant socioeconomic potential for the local community in terms of both increased employment and additional indirect opportunities for regional business.

Secondly, Salazar has appointed Endeavour Financial as Highfield's debt-finance adviser. Endeavour has raised more than $4 billion for juniors and mid-caps by tapping into its network of global financial institutions.

After the concession is granted, Highfield would quickly finalise terms with its construction and engineering contractor, Acciona, although it will undertake part of the development itself.

"The stand-out feature about Muga," said Salazar, "is that it will be one of the highest margin, low-cost potash producers in the world".

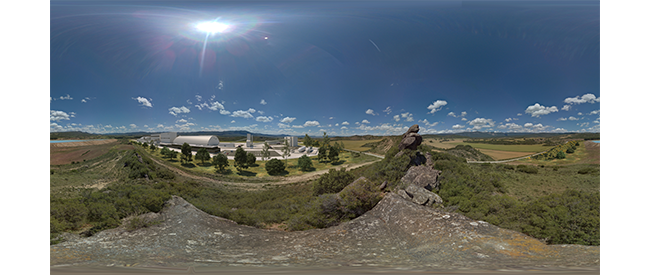

Mineralisation in most underground potash mines starts at around 1,000m depth, while Muga is at 350m.

"And there's no aquifer on top of the mineralisation. Normally, you need to build a shaft just to go through the aquifer to the mineralisation. You need to freeze the water, to get material up through the shaft. But we have two nice declines," said Salazar.

"We're going to do a simple, standard room-and-pillar mining method. And the processing will be relatively simple as well."

"Two other factors make Muga special: the high-tech, modern infrastructure all around already in place - in other words what you'd expect in a modern, western European country: motorways, railways, electricity grid station and, in addition, the deep-sea water port of Bilbao is just 200km from the mine gate," he said.

"Quite often, in countries such as Canada and Russia, which are big potash producers, the mines are in the middle of nowhere, so you have to build a lot of infrastructure for the project, and that's expensive."

Last but not least, the other main selling point is Muga's superb location: in the middle of the European markets it intends to serve, especially France - not to mention Spain itself, where demand is very strong and there is not much supply. Low costs and flexibility linked to transportation and logistics give Highfield a significant competitive edge over Russian or even Canadian producers.

"Our end-users are on our doorstep, although we might also sell to Brazil because of seasonality and as it's such a large market, but even Brazil is an easier and more direct trip from Spain than for many of our rivals. Southern Europe is a great place to be," said Salazar.

The deposit has proved and probable reserve comprising 108.7Mt at 10.2% K2O and resources of 234.75 million tonnes at 12.3% K2O (measured and indicated).

Salazar isn't worried about low potash prices because "in a cyclical business, the key is to be a high margin producer".

"Competitive dynamics will take care of the cycle and Highfield will be always better positioned than most peers, even if prices were to retreat in two or three years' time when Muga is expected to reach first production," he added.

Due to the fragmentated nature of the European market, Europe trades at a premium to global prices.

The project's NPV (8% discount) is estimated at €1.97 billion, and it has a 25% internal rate of return, and a forecast EBITDA of €310 million per annum at full production based on MOP price forecasts provided by the well-regarded CRU Group International.

C1 cash costs have been estimated at €82/tonne, including a salt by-product credit.

Highfield has signed MoU's that, if activated, would cover its output, which underlines pent-up demand potential. Market growth of 2.5% per annum has been forecast by analysts as the world's burgeoning population seeks higher crop yields, which, in turn, leads to an increased requirement for fertilisers.

"As we have about half the capex intensity per tonne of potash compared to other potash producers, the operation will be extremely competitive, while on the ESG front, Highfield will be the first potash producer not to leave salt on the surface after production," said Salazar.

As a native Spanish-speaker, Salazar is well placed to read the runes. "Put it this way, we are prepared and eager to move and I am very optimistic about the potential of Highfield" he said.

ABOUT THIS COMPANY

Highfield Resources

Highfield Resources - at a glance

Highfield Resources is a Spanish potash developer. The Company’s flagship project is the Muga Project (“Muga”) which covers an area of some 80km2 in the provinces of Navarra and Aragón.

Head Office: Avenida Carlos III, 13 - 1°B, 31002, Pamplona, Spain

Registered Office: C/- HLB Mann Judd, 169 Fullarton Road, Dulwich, SA 5065, Australia

Tel: +34 948 050 577

Fax: +34 948 050 578

Email: info@geoalcali.com

Web: www.highfieldresources.com.au

Major Shareholders: EMR Capital.

Board members: Ignacio Salazar, Paul Harris, Pauline Carr, Roger Davey, Luke Anderson, Katelyn Adams. Full corporate team listed here.

Social Media: