Since acquiring the under-explored Menzies and Goongarrie projects north of Kalgoorlie in 2019, Kingwest has increased Menzies' resource by 160% to almost half a million ounces of gold, delivered a robust scoping study and discovered stellar grades in first-pass drilling at Goongarrie.

CEO and geologist Ed Turner, who was founding CEO of Galena Mining and delineated the Abra high-grade base metals deposit in WA which is now in development, describes Menzies as one of the best projects he's worked on.

He's excited about the prospect of breathing new life into Kingwest's ground in a region renowned for high-grade deposits.

Kingwest's Menzies project has recorded historical production of 787,200 ounces at 18.9g/t.

The bulk of this was from underground operations prior to 1943 averaging 22.5g/t gold.

It's seen little exploration since about four years of openpit mining wrapped up in the late 1990s.

"At the Menzies gold project, there's 15km of strike and for an exploration geologist like me, the potential to find more gold is just incredible," Turner said.

"There's gold everywhere, it's exciting - it's a matter of where to drill and where to focus.

"I've been doing this more than 30 years and it's one of the best projects I've worked on."

Drilling at Kingwest Resources' Lady Harriet prospect at the Menzies gold project

Kingwest has increased Menzies' resource to 446,200oz grading 1.3g/t and released a positive scoping study in March.

The study estimated initial capital costs of just A$2 million for a 31-month, eight-pit toll treating operation generating about $80 million in profit in less than three years.

Turner said the company could look at a stand-alone development in the future, but the scoping study had demonstrated Menzies offered a very good return for a very small investment over a short period of time.

"And we could be in production in 12 months," he said.

All the deposits sit in granted mining leases and the project lies on the Goldfields Highway, with access to power and water and numerous processing plant options nearby.

Kingwest has already begun initial discussions regarding ore treatment options.Metallurgical test work has indicated gold recoveries of up to 99%.

Notably, the scoping study excluded Menzies' underground potential.

Kingwest has since drilled, and received assays for, an additional 7,000m, with promising highlights including 1m at 28.54g/t gold, within 7m at 7.14g/t, from 210m at Yunndaga.

Another significant intersection was 2m at 15.17g/t, including 1m at 22.83g/t from 125m, at Lady Irene.

The company has just raised $3 million and has further resource expansion and exploration drilling underway, including looking for deeper extensions at the Menzies project.

"We know the mineralisation at Menzies has deep roots," Turner said.

He said previous mining had gone to 600m vertical depth at the Princess May shoot at Yunndaga, although the average depth of underground mining at the existing deposits was less than 200m.

The company's drilling focus is then set to shift from Menzies to Goongarrie, where Kingwest announced a standout intersection in February of 6m at 17.2g/t gold.

The above intercept was part of a broader 38m at 3.1g/t in an aircore hole which ended in mineralisation.

"It's a very exciting intersection," Turner said.

Although Goongarrie has seen some historical mining, Turner says the project's greater potential has been overlooked partly due thin salt lake cover over about 80% of the property.

Kingwest believes Goongarrie has the potential to host a major gold discovery.

"We've got some very exciting targets, particularly at the north of Goongarrie, which we plan to drill with a track-mounted air core rig as soon as possible," Turner said.

"It has to be customised to drive on the lake and consequently there aren't too many of them around."

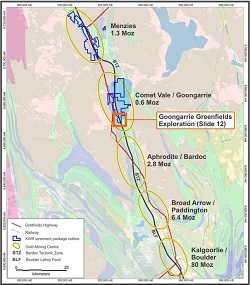

Kingwest Resources' projects are in WA's Goldfields

Turner said Goongarrie was on a very prospective trend, sitting on the strike extension of the 1.7 million ounce Aphrodite gold deposit on Bardoc Gold's leases 7km to the south.

"Potentially multimillion-ounce deposits can be found on that trend," he said.

The company completed its acquisition of both projects in March through a final cash and shares payment to Horizon Minerals.

Horizon, a fellow Goldfields-focused gold company looking to be in development next year at its Boorara project, is Kingwest's major shareholder with about 15%.

On top of its location in a mining-friendly jurisdiction, Kingwest benefits from the experience of well-known mining executives on its board, including Adrian Byass, Jon Price and Jonathan Downes.

Greg Bittar was also appointed non-executive chairman in July, bringing extensive finance expertise as Kingwest advances Menzies towards production.

"By the end of this year, we should have a lot more drilling results in hand," Turner said.

Kingwest Resources CEO Ed Turner

"We'll continue to increase the footprint of mineralisation at Menzies in particular and follow the high-grade shoots deeper.

"And at Goongarrie, delineate the primary mineralisation in the southern area and hopefully have a discovery in the northern area under the lake."

Despite the company's rapid progress, Turner said Kingwest's value was yet to be fully recognised in its share price.

"Our enterprise value per resource ounce is only about $30/oz, compared with our peers - other gold explorers and developers who are more like $90/oz," he said.

"There's a lot of upside for investors now."

ABOUT THIS COMPANY

Kingwest Resources

HEAD OFFICE:

- Unit 3, Churchill Court, 335 Hay Street, Subiaco, WA 6008 AUSTRALIA

- Telephone: +61 8 9481 0389

- Email: admin@kingwestresources.com.au

- Web: www.kingwestresources.com.au

SOCIAL MEDIA:

DIRECTORS:

- Gregory Bittar

- Jonathan Downes

- Ashok Parekh

QUOTED SHARES ON ISSUE:

- 243 million

MARKET CAP (at August 17, 2022):

- A$17.5 million

MAJOR SHAREHOLDERS:

- Horizon Minerals Limited 15%

- Top 20 40%