Effective boards are crucial to mining companies achieving their objectives and to the wider challenge of changing the perception of mining. But Swann's analysis of mining companies listed on the London Stock Exchange and AIM[1], reveals that many boards lack the diversity of background and membership turnover to bring fresh ideas.

Key findings

In our sample of 686 individuals on the boards of 118 London Stock Exchange and AIM-listed mining firms:

- 44% have a tenure of five years or more

- 23% have a tenure of nine years or more

- Only 10% are women

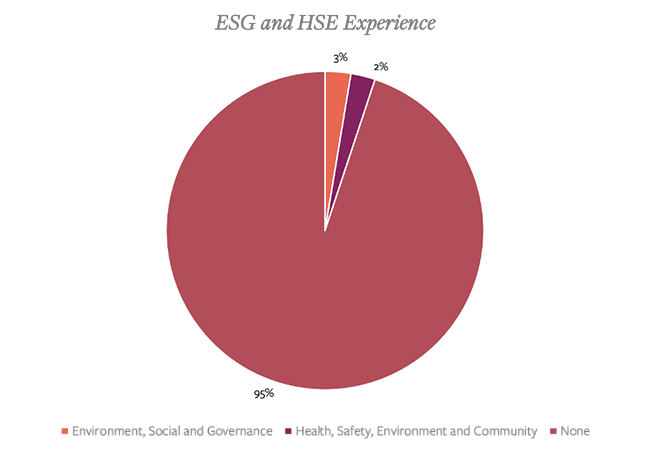

- Only 5% have backgrounds in health, safety, environment and community and environment, social, and governance. Of these, half are women.

Board size, tenure and effectiveness

The board size of the organisations we analysed varied from two to 16 individuals. Juniors averaged five members, mid-tiers averaged eight, while the majors have more than ten members on their boards. More than one in seven (15%) board members serve on at least two boards.

Nearly a quarter (23%) have served on their board for more than nine years and 44% for more than five years. This board rigidity is particularly prevalent in juniors.

Mining is a small community, and directors often rotate within the sector. While this allows the transfer of knowledge and expertise, it can lead to a risk of stagnation. While there is no suggestion that directors should be required to leave their boards on the basis of tenure alone, refreshing board membership as opportunity allows can result in improved financial performance and governance, better-informed remuneration practices and other benefits.

We recommend regular independent board assessment and reviews and that boards open themselves up to a more diverse membership of men and women from different functions, sectors, and skills.

Diversity

When we analysed the board members in our sample by experience, we found more than two fifths (42%) came from a financial background, including banking, consultancies and other organisations supplying financial services to the mining sector. In comparison, a third (33%) have a background in mining, coming from exploration, construction, and related areas. Those with legal expertise represented 8% of board members.

Only 10% of board members are women, with half of these being on the boards of major mining companies. From a global perspective, PwC found that mining is the worst sector for gender diversity, with just 5% of board seats held by women in the top 500 mining companies of the world. While AIM/LSE-listed companies have double that proportion, further progress is required.

We recommend a greater diversity of experience, background and gender on mining boards. Specialist expertise in environment, sustainability, community affairs and technology will strengthen all leadership teams. Mentoring programmes to help female executives into the C-suite and eventually board roles should be encouraged.

ESG and Innovation

Only 5% of those on the boards in our sample had expertise in health, safety, environment, community, environment, social, and governance. Of this five per cent, half were women.

Given the increasingly high profile of these issues and the fact that most mining companies have an ESG department, it is disappointing that this area is not a priority on their boards.

The environmental impact of mining and related issues is a critical PR challenge that affects the industry's relationship with society, the social licence to operate and our ability to attract new talent.

We recommend establishing a permanent position for one or more ESG professionals on the board of directors. Bringing in expertise from the worlds of digital technology, robotics, and AI will bring new perspectives that may reduce costs, increase efficiency and lessen the environmental and social impact of operations.

Conclusion

Mining firms need to take bolder initiatives to bridge the gap between their current and target future performance. Better governance and increased diversity in the board of directors has the potential to address challenges around environment, social and gender.

There are many opportunities and challenges in making mining a more sustainable, socially responsible, support system and backbone of the world. The wider mining sector should follow the example of industry leaders and pledge to take positive actions towards more responsible mining and so change society's perception of the sector.

To download the full report, Board Rigid, visit https://the-swann-group.com/research/

[1] Initial research conducted Q2 2020

ABOUT THIS COMPANY

Swann

Swann is an executive search and advisory specialist with a international presence. For more than 25 years we have partnered with global organisations that provide the materials, energy and infrastructure that make the world work.

Our services are delivered through three specialist practices: the Executive Search Practice, the Advisory Practice and the Board Practice.

HEAD OFFICE:

- The Bloomsbury Building, 10 Bloomsbury Way, London, WC1A 2SL

- Tel: +44 20 7770 6799

- Website: the-swann-group.com