Highfield Resources has secured enough funding to fully bring the first phase of its Muga potash project in northern Spain to fruition, with a $220million investment from Yankuang Energy and investors.

The package brings the development-stage project together with Yankuang, a Hong Kong and Shanghai listed energy producer and a number of strategic investors including Beijing Energy and Singapore Taizhong, a trading house.

"This is to fully fund the Muga project," Olivier Vadillo, head of marketing and investor relations, told Mining Journal.

"This is very much a transformative strategic partnership that we're building here, to create what will be a global project in very distinct but complementary geographical location," he added.

YOU MIGHT ALSO LIKE

Partnership key

Yankuang is principally engaged in mining, high-end chemicals and new materials, new energy, high-end equipment manufacturing and intelligent logistics. It is a majority shareholder in ASX listed Yancoal Australia. Beijing Energy meanwhile is China's leading renewables supplier.

"On completion of this deal, we believe we will have the assets, the team and the capital to unlock and create significant value for Highfield," Ignacio Salazar, chief executive, said in a release to the market.

The transaction is expected to be completed in early 2025. In the interim, Highfield said it would seek to raise up to US$15 million to support the company's planned activities. This will be via an institutional placement to raise up to $12million and and extra $5 million from an entity managed by EMR Capital.

This amount is conditional on shareholder approval at an extraordinary general meeting and a follow-on offer of new shares under a share purchase plan.

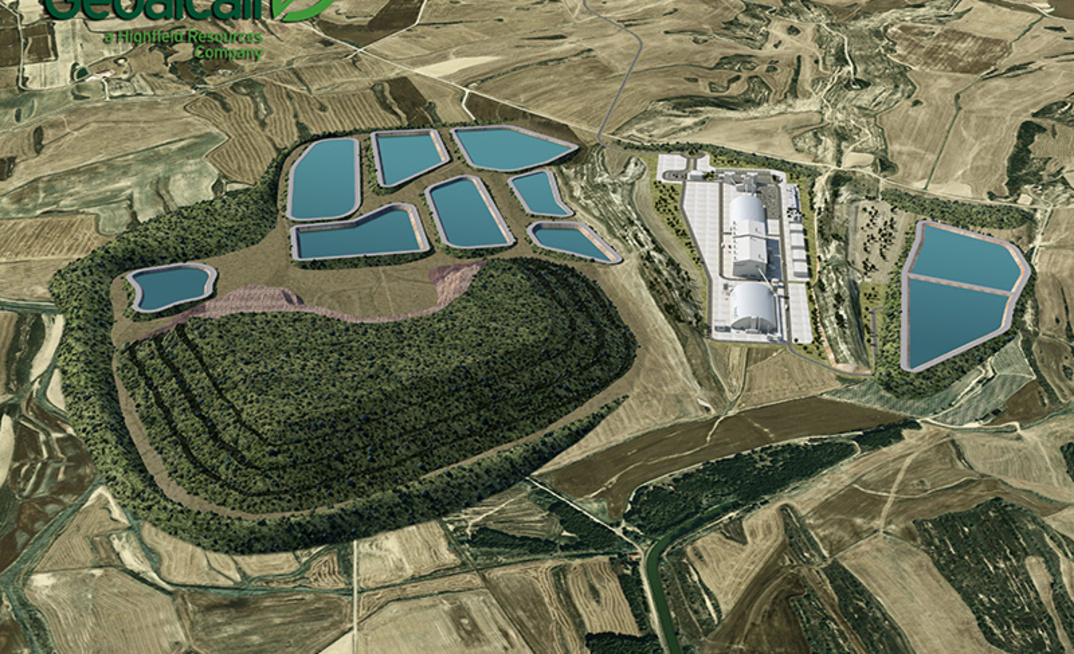

Muga is a hard rock underground project. It is fully permitted and construction-ready. It is forecast to produce 500,000tpa of potash for European fertiliser markets and is expected to be one of only two potash mines in southern Europe.

"Muga will be very much a European project feeding the European markets," Vadillo told Mining Journal.

"We're only about an hour's drive, from the French border, and there's a huge amount of demand in the south of France as well, a lot of buyers that we know very, very well," he added.

A further €209 million expansion would double production and generate earnings of around €400 million pa over 30 years.

Highfield is also developing the Southey project in Saskatchewan, Canada. This is a brine project wholly owned by Yancoal Canada, a subsidiary of Yankuang Energy. It was established in 2011 and released a PFS in 2016. It is a greenfield potash mine project with environmental approvals for a 2.8Mtpa operation that could reportedly support a minimum 65-year mine life.

Southey will be a solution mining potash project, whereby both injection and extraction wells are drilled to the target ore body. Heated brine is injected underground, where the water dissolves the potash layer, and the potash rich brine is pumped back to the surface for processing.