The development of mineral asset valuation standards, when compared to the IRRS for mineral resources and ore reserves, is relatively recent (2000 onwards). Furthermore, these have evolved through the amalgamation of common practices established in the financial sector (auditors and analysts) and technically focused valuation practitioners. The International Mineral Valuation Committee ("IMVAL") was formed following VALMIN Seminars in October 2011 in Perth and April 2012 in Brisbane. IMVAL members comprise a number of representatives from the national valuation codes (Valmin, SAMVAL and CIMVAL), the SME (United States), the International Institute of Minerals Appraisers with a number of other organisations as Observers.

International valuation standards

Three main international valuation standards have been established to date, which are focused on the mining and metals sectors. These are largely reflective of the approach followed by professional institutions in establishing the IRRS and comprise:

- Australasian Code for Public Reporting of Technical Assessments and Valuations of Mineral Assets (2015 Edition) (Valmin Code 2015)

- The South African Code for the Reporting of Mineral Asset Valuation 2016 edition, prepared by the South African Mineral Valuation Committee Working Group under the joint auspices of the Southern African Institute of Mining and Metallurgy and the Geological Society of South Africa, through the SAMCODES Standards Committee (SAMVAL Code) 2016 - (www.samcodes.co.za)

- The Standards and Guidelines for Valuation of Mineral Properties endorsed by the Canadian Institute of Mining, Metallurgy and Petroleum, as amended (CIMVAL Code) 2003.

- The International Mineral Property Valuation Standards Template (the "IMVAL Template") published by the International Mineral Valuation Committee in 2018.

Valuation approach and valuation methods

In general, there are three main accepted analytical valuation approaches that are in common use for determining fair market value (defined below) of mineral assets, each of which largely rely on the principle of substitution, using market-derived data.

The fair market value is defined in respect of a mineral asset, as the amount of money (or the cash equivalent of some other consideration) determined by a relevant expert for which the mineral asset should change hands on the relevant date in an open and unrestricted market between a willing buyer and a willing seller in an ‘arm's length' transaction, with each party acting, knowledgeably, prudently and without compulsion. The fair market value is usually comprised of two components, the underlying technical value (defined below) of the mineral asset, and a premium or discount related to market, strategic or other considerations.

The technical value is defined as an assessment of a mineral asset's future net economic benefit at the valuation date under a set of assumptions deemed most appropriate by a relevant expert or specialist, excluding any premium or discount to account for such factors as market or strategic considerations.

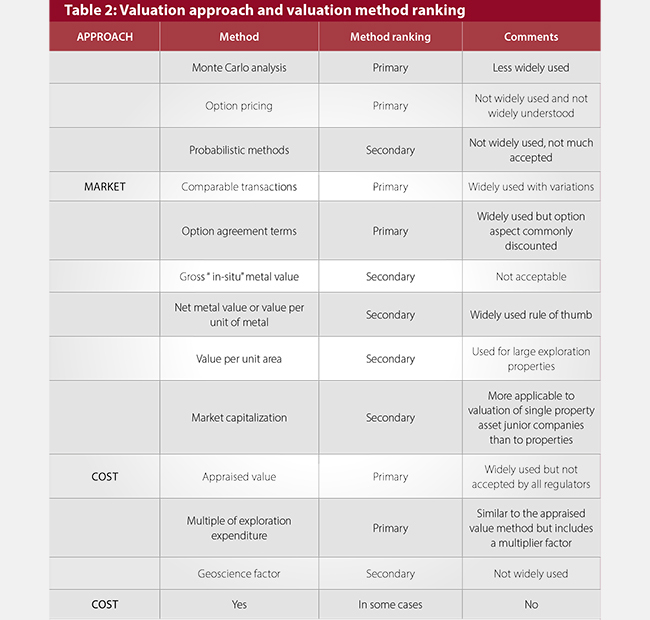

Valuation methods are, in general, subsets of valuation approaches and, for example, the income-based approach comprises several methods. Furthermore, some methods can be considered to be primary methods for valuation while others are secondary methods or rules of thumb, considered suitable only to benchmark valuations completed using primary methods.

In summary, however, the various recognised valuation methods are designed to provide the most accurate estimate of the mineral asset or property value in each of the various categories of development. In some instances, a particular mineral asset, property or project may comprise assets which logically fall under more than one of the previously discussed development categories.

Application to the valuation of mineral assets

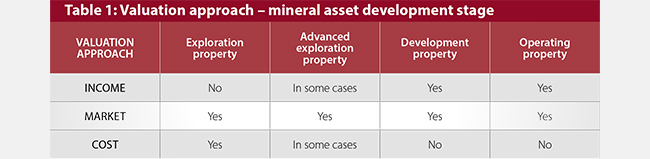

The application of valuation approach and method to mineral assets is largely dependent upon determined development status. Table 1 specifically compares the application of the three valuation approach categories to mineral assets classified as: exploration property; advanced exploration property; development property; or operating property.

Table 2 provides an assessment of the application of differing valuation methods within each valuation approach as well as their relative ranking.

Exploration property and advanced exploration property

In the case of an exploration property, and to a lesser extent an advanced exploration property, the potential is more speculative and the valuation is dependent to a large extent on the informed, professional opinion of the valuator. Where useful previous and committed future exploration expenditure is known, or can be reasonably estimated, the Multiple of Exploration Expenditure (MEE) method (also known as the Past Expenditure Method) is considered to represent one of the more appropriate valuation techniques.

This method involves assigning a premium or discount to the relevant effective Expenditure Base (EB), represented by past and/or future committed expenditure, through application of a Prospectivity Enhancement Multiplier (PEM). This factor directly relates to the success or failure of exploration completed to date, and to an assessment of the future potential of the asset.

The method is based on the premise that a grassroots project commences with a nominal value that increases with positive exploration results from increasing exploration expenditure.

Conversely, where exploration results are consistently negative, exploration expenditure will decrease along with the value.

The MEE method relies on the assumption that well directed exploration adds value to a property. This is not always the case and exploration can also down- grade a property. The PEM, which is applied to the effective expenditure therefore commonly ranges from 0.5 to 3.0.

A similar situation may apply where economic viability cannot be readily demonstrated for a mineral resource assigned to a higher confidence category. In these instances, it is frequently appropriate to adopt the in-situ mineral resource (or yardstick) method of valuation for these mineral assets or properties. This technique involves application of a heavily discounted valuation of the total in-situ metal contained within the resource. Historically, this usually equates to a range of 2% to 4.5% of the spot commodity price as at the valuation date but may vary substantially in response to a range of additional factors including physiography, infrastructure and the proximity of a suitable processing facility.

Pre-development, development and operating property

Mineral assets and/or properties which are classified as either a pre-development, development or operating property are generally accompanied by measured and indicated mineral resources and ore reserves, specifically where technical studies completed to a minimum of pre-feasibility study (PFS) level demonstrate that extraction is both technically feasible and economically viable.

In such instances mining and processing assumptions, operating expenditures and capital expenditures are either known or can be reasonably determined. Accordingly, valuations can be derived with a reasonable degree of confidence by compiling a discounted cash flow (DCF) and determining the net present value (NPV).

Image: iStock/intst

Explore the full Mining Journal Intelligence Global Finance Report 2022

Technical Glossary

MINING JOURNAL GLOBAL FINANCE REPORT 2022

Technical Glossary: Technical study standards

This chapter is authored by leading global mining expert, SRK Consulting

MINING JOURNAL GLOBAL FINANCE REPORT 2022

Technical Glossary: Mineral asset valuation standards

This chapter is authored by leading global mining expert, SRK Consulting

MINING JOURNAL GLOBAL FINANCE REPORT 2022

Technical Glossary: Permitting and Sustainability

This chapter is authored by leading global mining expert, SRK Consulting

MINING JOURNAL GLOBAL FINANCE REPORT 2022

Technical Glossary: Funding options: technical expectations

This chapter is authored by leading global mining expert, SRK Consulting

MINING JOURNAL GLOBAL FINANCE REPORT 2022

Technical Glossary: Mineral Resources and Ore Reserve reporting standards

This chapter is authored by leading global mining expert, SRK Consulting