Mining companies struggle to reduce water withdrawals

The world's biggest mining companies have failed to deliver meaningful improvements in water efficiency in the past few years, with progress hampered by patchy recycling rates, according to research by Mining Journal Intelligence (MJI).

Mining is a significant consumer of water, used in the extraction and processing of minerals and many other purposes, such as dust control. Cutting consumption is vital for reducing potential conflicts with competing water users, including communities and agriculture, and for protecting biodiversity, particularly in areas of water scarcity.

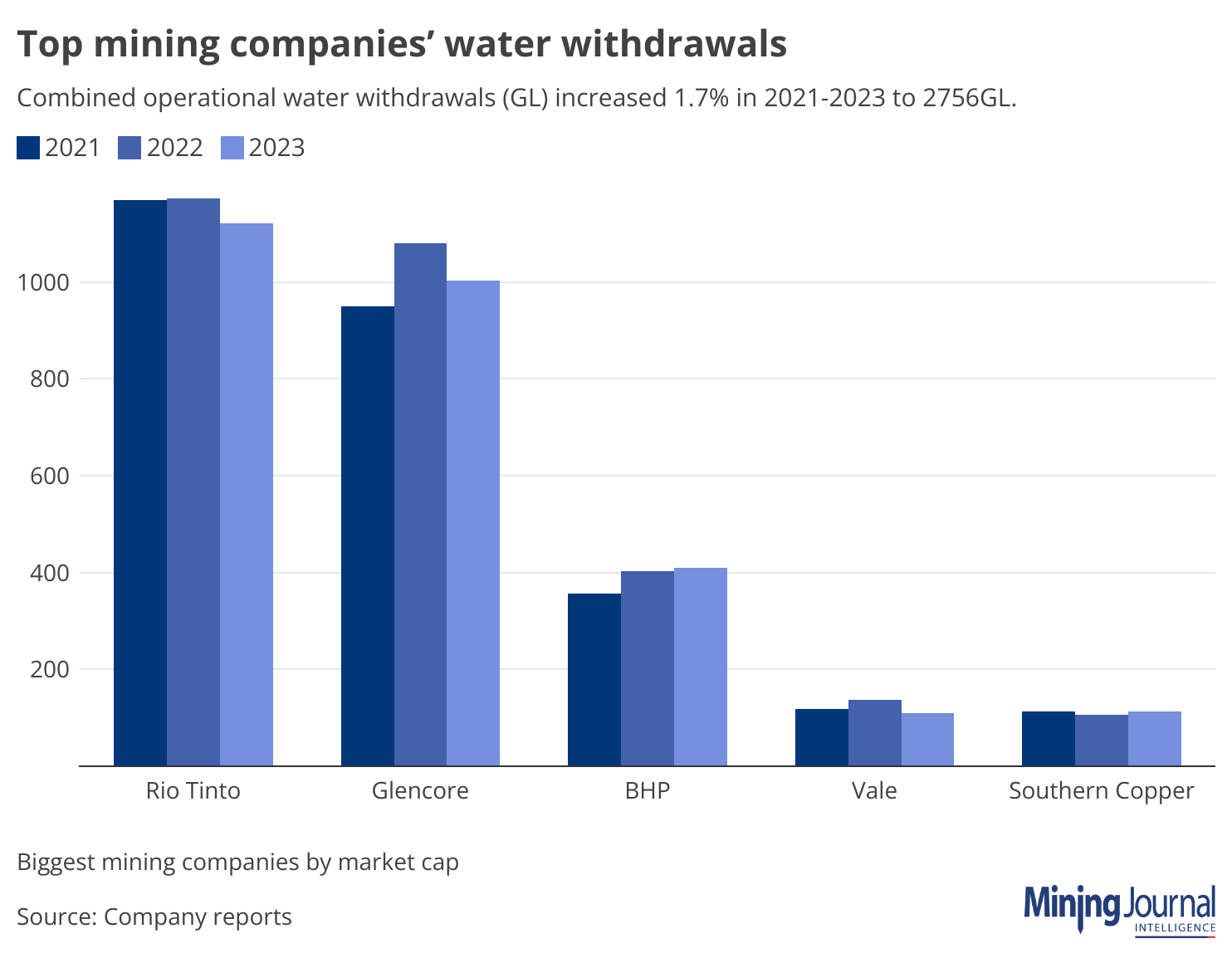

But operational water withdrawals by the top five miners by market cap increased by 0.7% between 2021 and 2023, to 2756GL from 2709GL, data gathered from company reports show.

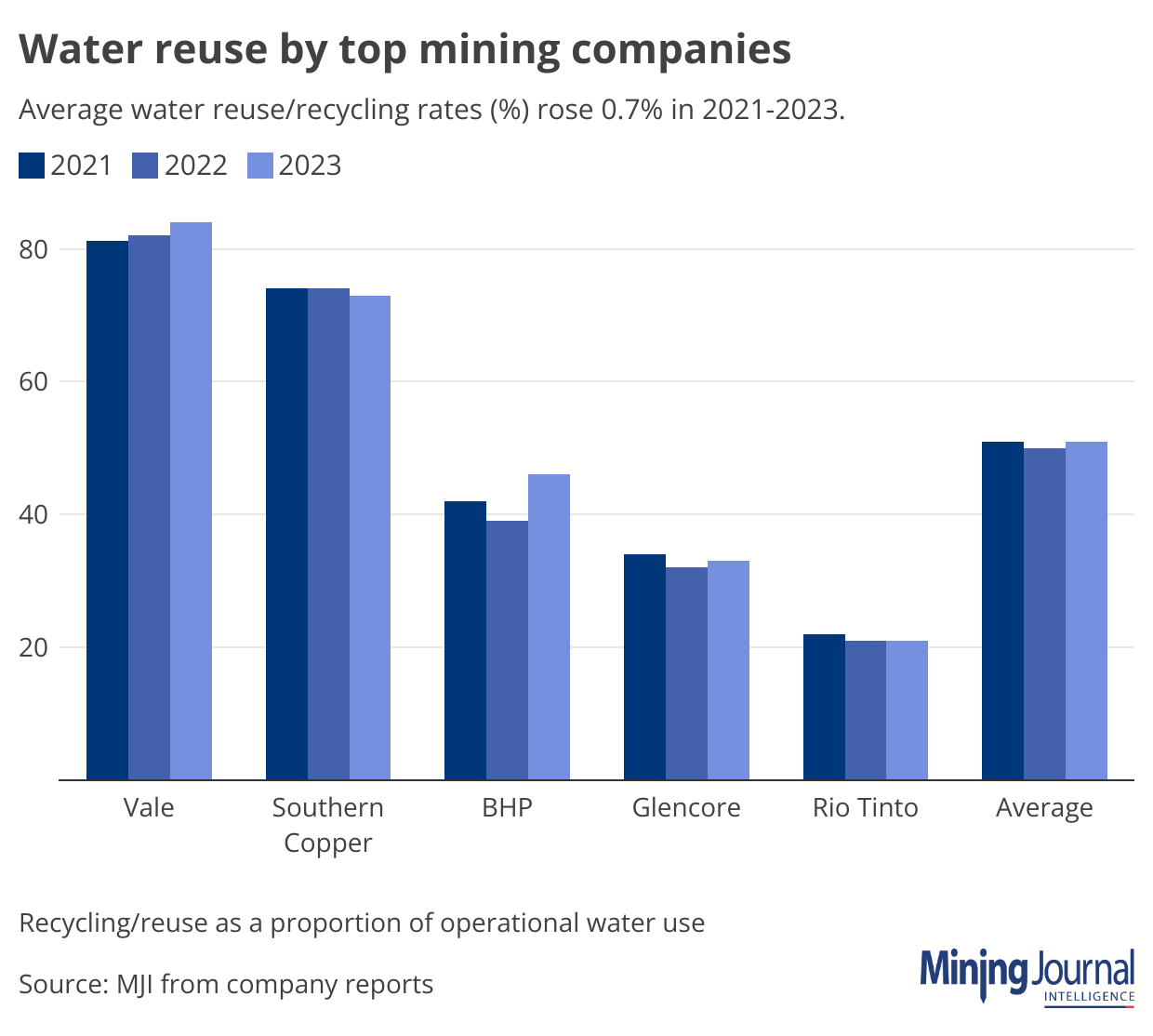

This in part reflects slow progress on water reuse and recycling, which averaged 51.1% in 2023, compared to 50.7% in 2021.

The rise in water withdrawals does not appear linked to mineral production volumes. Rio Tinto and Vale were the only companies to cut water withdrawals over the period, while their production increased last year. BHP and Southern Copper saw production dip in 2022 before smaller rises in 2023, while Glencore's copper output declined while coal production increased.

Varying trends

Data from the five companies shows varying trends in water withdrawals and reuse.

Rio Tinto's water withdrawals were consistently the highest but fell from 1170GL in 2021 to 1122GL in 2023. The company also had the lowest proportion of water reuse, at 22% in 2023.

A significant portion of water (429GL) was allocated to the company's Australian salt operations, which evaporate seawater, which could explain the higher withdrawals and lower reuse/ recycling rates.

Vale was consistently the top performer on reuse/recycling, which increased from 81% to 84%. Vale's iron ore output rose to 321Mt in 2023 from 308Mt in 2022 and 313Mt the previous year.

Mining Journal Intelligence is currently assessing data on water management and other environmental, social, and governance metrics for a forthcoming new report.

By Celia Aspden

We would love to hear your feedback!

Please email sam.williams@aspermont.com with any questions, suggestions, or comments about our research.