Richard Lloyd, Minexia chief executive

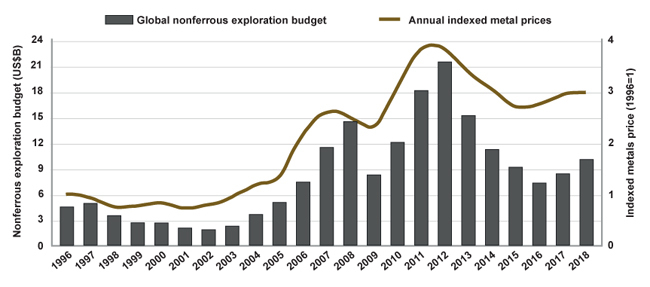

A technology driven alternative has been needed for some time in order to overcome the challenges of a fragmented industry that is overly reliant on brokers, fickle markets and personal business connections.

High net-worth individuals already possess a high level of digital literacy, yet, to date, there has not been a viable online investment product available to investors with a specific mining, project development or exploration sector focus. If investors and issuers alike are treated fairly and in an open and transparent manner, the concept should not only complement, but disrupt the way mining and exploration is funded at the junior to mid-cap levels.

A parallel can be drawn against other platform intermediaries such as Airbnb or Uber and their transformation of the traditional accommodation and transport spaces, respectively, using platform technology.

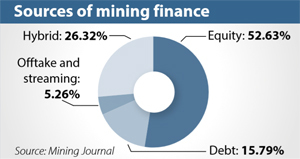

The equity financing market for junior mining, project development and exploration is tightly controlled by investment banking and brokerage firms that typically target a limited pool of capital in the form of private equity groups. Mining companies raising through public markets are also competing for capital with thousands of companies across dozens of industry sectors as well as their own huge sector where there are many sub-standard companies or projects.

There are in excess of 90 AIM-listed resources stocks, more than 700 ASX entities, 212 TSX equities and 935 TSXV firms - it's an overwhelming selection among which to stand out.

Given the specialist nature of mining and exploration companies, these companies are more likely to thrive in an environment where they are competing only within their own sector and on their own merit. Additionally, mining companies should know that this source of capital is actively investing or looking to invest in the mining and exploration sector.

To attract these investors into such an environment, companies presenting financing opportunities should be vetted.

There is some $200 trillion of high net worth capital globally, yet this wealth does not have a clear path through to the small resources space. Additionally, with a shift in high net worth and family office investors increasingly looking to deploy capital to direct investments rather than through managed funds and ETFs, a dedicated sector platform approach should prove an attractive proposition for investors.

The platform

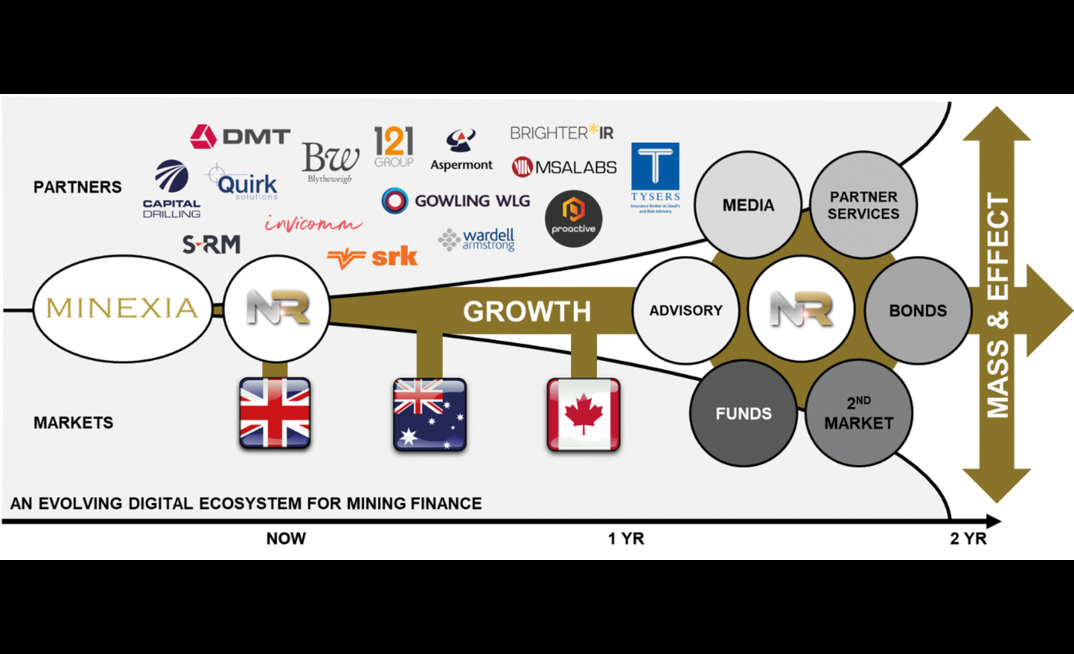

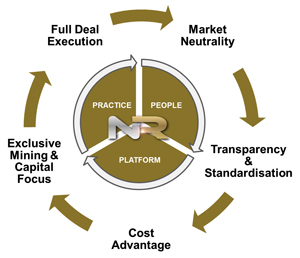

These are the facts that have encouraged Minexia to create the NR Private Market platform. When designing platform objectives and functionality, several key considerations were addressed.

Market neutrality: a platform-based financing model should be neutral, never promoting one opportunity over another, or providing investment advice.

Transparency and standardisation: any platform should provide a level playing field giving all members access to the same information presented in a standardised format.

Exclusive mining and capital focus: the platform should be for a mining- focused investor base only, unlike many brokers who may have a broader investor base often across a vast range of industry sectors.

Cost advantage: any disruptive or technology-based approach should be cost effective and provide an advantage to all users. Approved investors in that sense should have free and uncommitted access, without fees or spreads on transactions. The aim was to establish competitive transaction closing fees for issuers 40% below the industry standard.

Full deal execution: service should start with deal origination and proceed through to facilitating investor due diligence, then conclude with online document execution and transaction completion. The industry need is for a full-execution, online mining-finance platform.

Once established …

Traditional sources and mechanisms for broker-sourced finance are failing to inject much needed capital into early and intermediate-stage natural resource projects. This failure is complex but is in many ways a function of communications. The irony is that in this digital age there is simply too much information, resulting in over-saturation and proliferation of low quality ‘noise'.

Platforms are bringing users (or subscribers) and providers together. Nobody purchases anything any longer without first looking at availability and price on the internet. The overheads for this model are lower and these cost savings can be passed on.

Returning to the Airbnb example, the company doesn't have to locate a plot of land, build a hotel, furnish rooms, restaurants and a gymnasium then then refurbish those every three years. Airbnb does not own a single property yet is able to find the perfect family cottage in Cornwall for a young family with a dog in tow - assuming the ‘provider base' is sufficient.

There is no shortage of projects in the mining and exploration space. Vetting these assets and providing investor access to pre-screened deals in a similar but more rigorous and market-compliant process to that used by Airbnb would only accelerate the development of quality projects - Airbnb would surely remove a poorly-rated, damp, cold, unfit property from its platform.

The NR Private Market platform is striving to provide clarity and focus to a junior mining finance space devoid of both. In essence, a vetting or filtering of the plethora of public and private opportunities available would provide information in a standardised and comprehensive format to a community of investors with an appetite for resources.

From the Issuer perspective, the platform approach reaches a far wider retail and, perhaps otherwise opaque, high net worth or family office investor base. The requirement for direct issuer or unsolicited broker communication is removed, whilst also protecting the investor identity until the final stages - subscription - of the fundraising process. The private companies and issuers would also benefit from this wider and deeper audience.

Moreover, a global platform-based approach is agnostic to investor location and requires only that said investor is qualified/sophisticated and/or of sufficient wealth, as per regulatory definitions. This challenges the traditional and nepotistic broker model when investment opportunities are limited to a narrow part of the investor spectrum.

The platform-based approach therefore seeks to maximise the opportunity provided by international, 24/7 accessibility and complete transaction functionality.

For the investor

The overriding investor rational is the ‘level playing field'. Platform investors are provided with the same information that institutional investors receive and the transactions are on the same terms.

NR Private Market's first transaction, which was oversubscribed, raised $4.75 million (C$6.25 million) complementing private placement and brokered solutions. Retail investors were provided with the opportunity to invest alongside a billion-dollar Asia-based asset manager on identical terms. Due to the scale achieved through pooling of smaller investors, all investors had access to company management and due diligence data rooms; a privilege generally reserved for institutional investors. Costs, and therefore fees to the issuers, are also kept to a minimum and below the current broker rates as overheads are minimal.

The concept can, of course, only be successful - as with the Airbnb and Uber examples - with an established level of integrity and trust. Initially, this will be built on the foundations of Minexia executives, a team of experienced mining professionals who have all worked with highly reputable mining companies and financial organisations across both the technical and financial aspects of mining. Though the team does not recommend any opportunities, it commits to screening or vetting each deal presented against an institutional standard. This ensures only quality and credible investment opportunities are showcased.

The future of the platform will be decided by the ability of this process to put genuine opportunities together with investors. Only through the maintenance of standards will trust ultimately be built and the pool of investors and capital raising opportunities deepen.

This future would enable a platform on which secondary trading of private stocks, bond issuance can be executed and a library of previous deals, where exploration and development updates are constantly available to subscribers.

ABOUT THIS COMPANY

MINEXIA

MINEXIA is a mining investment, development and advisory company based in London and Luxembourg and has been formed by a multi-disciplinary team with over 80 years’ experience in the mining, mining finance and risk management sectors with organisations including; Barrick Gold, Reservoir Minerals, Nevsun Resources, Standard Bank, BP and SRK Group.

HEAD OFFICE:

- 86-90 Paul Street, London, EC2A 4NE

- Phone: +44 20 3893 2781

- Website: www.minexia.com

- Email: info@minexia.com