To be fair, these figures included the first full year of production by Lundin Gold from Fruta del Norte mine in Ecuador (242,200oz) and the first production from Victoria Gold's Eagle mine in Yukon, Canada (116,000oz). However, the growth trend in the intermediates continued strongly as shown by a comparison with its 2018 aggregate production of 3.8Moz.

Only seven companies in the group (Alamos Gold, Hecla Mining, McEwen Mining, New Gold, OceanaGold, Pretium Gold and Torex Gold Resources produced fewer ounces in 2020 than in 2019, of which two (McEwen and Oceana) have been battling challenging situations for a couple of years, while Pretium and Torex produced marginally less than in 2019.

The consolidators in the group (Equinox Gold, Endeavour Mining, SSR Mining and Argonaut Gold) all grew their output with Equinox posting the highest year-on-year gain at 137.4% to 477,200oz. Endeavour will be looking forward to integrating Teranga Gold into its figures with the later posting 404,640oz of production in 2020, 40.1% more than in 2019.

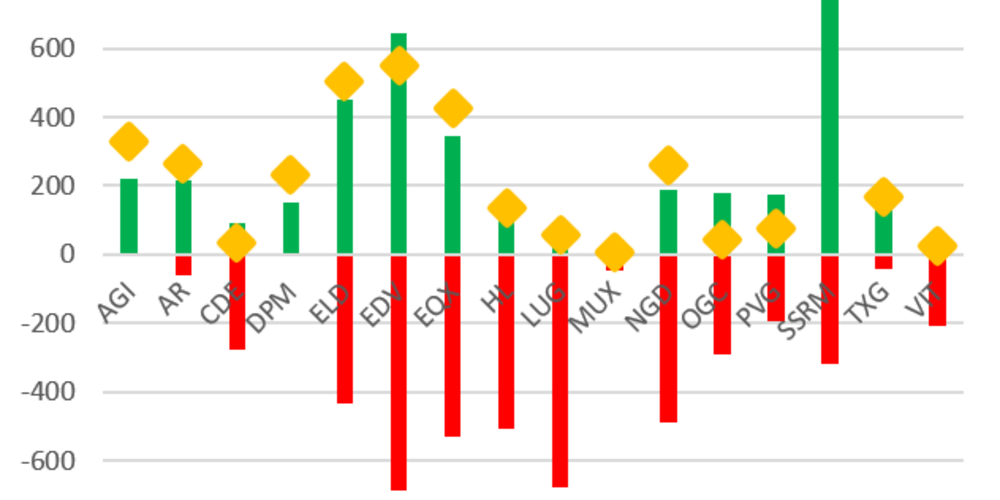

Intermediate gold producers cash, debt and working capital

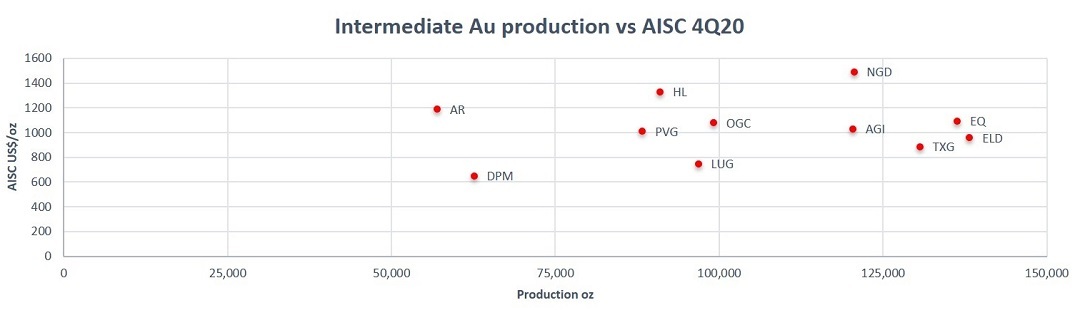

The intermediates saw their collective all-in sustaining costs increase by 4.2% in 2020 to US$1,072/oz, 7.3% higher than for the senior gold producers. However, there is far more variability in the group than is seen among the senior producers. Leading the pack is Dundee Precious Metals at $654/oz while at the other extreme is McEwen Mining at more than $1,800/oz. Eight of the group have AISC about $1,000/oz, with six having at least $1,200/oz.

Q4 production for the Americas intermediate gold companies

Intermediate producers have been using the higher metals prices to pay down debt which fell 10.8% in the last quarter of 2020 to an aggregate $4.8 billion. Argonaut, El dorado Gold, Lundin Gold and Victoria Gold all saw their debt load increase in the final quarter of the year while Torex, SSR, Pretium, New Gold and Endeavour saw their debt come down. Torex, New Gold and Pretium cut about $200 million each, more or less.

Aggregate cash increased slightly to $4 billion and working capital jumped 20.2% to $4.3 billion. This group is not a big payer of dividends although SSR Mining announced an inaugural dividend of 5c per quarter or 20c annualised, joining Endeavour and Dundee as dividend payers.