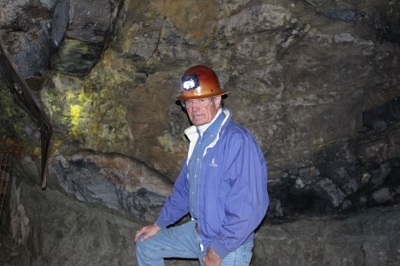

Western Uranium & Vanadium Corp. president and chief executive, George Glasier, has a proven uranium pedigree stretching back to the 1970s, when he helped build uranium pioneer, Energy Fuels Nuclear Inc. into the largest producer of uranium in the United States. Subsequently, he founded Energy Fuels, Inc. in 2006. Never, however, has he been more confident about uranium's prospects than he is now.

While the large and growing uranium supply deficit may be a serious headache for policymakers and end users, for investors it represents huge opportunity. And for companies in the uranium space, it is a chance to advance projects with a tailwind after a decade in the post-Fukushima doldrums.

Western Uranium & Vanadium holds mineral assets in western Colorado and eastern Utah, with attentions currently directed toward its Sunday Mine Complex. The company enjoys excellent relations with regulators in both states.

This proven asset is fully permitted and ready to scale-up production when the associated processing plant is built and comes online. In the meantime, ore has been produced and stockpiled underground, as development continues to increase near-term production capacity.

Waiting in the wings is the company's second major mine, San Rafael, situated just four miles from its Green River Utah processing plant site.

While Glasier is the uranium guru at the top, he is ably supported by the first-class management team he has brought together. This includes long-standing chief financial officer, Rob Klein and chief operating officer, Mike Rutter. As for the mining team, some have worked for Glasier previously and rejoined his newest venture.

Outside the C-suite, today's team at Western Uranium & Vanadium is a mix of old hands and new, with Glasier drawing on labour resources wherever they can be sourced. He has no issue introducing and empowering new blood into the ranks, whether that is graduate geologists quick and keen to learn, or transferring miners of other minerals able to apply and adapt their skills to underground uranium mining.

Glasier contrasted the solid drivers of today's resurgent nuclear industry with the more insubstantial foundations that underpinned the skyrocketing uranium price in the mid-2000s when hedge funds bought up uranium. This created conditions for a market overhang, because although production was insufficient, there was a lot of inventory, which meant no true supply deficit to sustain price rises. Ultimately, the Financial Crisis burst this bubble and prices went south fast.

Today, inventories are small as the post-Fukushima glut has been steadily exhausted, and supply is struggling to keep up with current demand, let alone the increased appetite to come from new reactor builds.

Added to Western Uranium & Vanadium's investment allure is the shift in geopolitics, indicated Glasier, which he described as "a game changer". "When the Russians invaded Ukraine, that was a turning point, because the US and Europe relied on the Russians for a lot of their uranium", he added.

Glasier picked out the Biden administration's onshoring strategy as having particular significance in boosting uranium's fortunes.

He acknowledged that the new-found political will in the West to end reliance on less than friendly countries for supplies is tempered for now by commercial realpolitik. In practice, the steady supply of uranium from the Russians cannot be replaced overnight, and so there is no choice but to do a deal with the devil until such time alternatives exist.

George Glasier explained that this uncomfortable reality has served to revitalise the hunt for uranium in the United States, as well as other locales considered acceptable, such as Canada, Australia, and even parts of Africa. "The security of supply issue from western nations importing most of their uranium, conversion and enrichment services from eastern countries is the driving factor reshaping the global nuclear fuel cycle", he expounded.

Glasier pointed to a recent Fact Sheet issued by the White House to Congress as evidence of the seriousness with which the situation is being taken in the corridors of power.

The document considered the improvement of domestic uranium enrichment capabilities to be "a national security priority, as dependence on Russian sources of uranium creates risk to the U.S. economy and the civil nuclear industry."

The White House observed that success of the initiative would be dependent upon a "long-term ban on enriched uranium product imports from the Russian Federation into the United States."

By way of focusing minds further, Rosatom (Russia) and Kazatomprom (Kazakhstan) uranium operations are shifting their gaze eastwards to trade partners China and India, the Chinese now contracting for much of the Kazakh production previously destined for the West. And with those two Asian powers building ever more reactors, competition for the mineable global resources of uranium that currently exist is only set to mount. In addition, Glasier highlighted how new modular reactors are increasingly coming into the picture, further exacerbating the supply deficit.

But if Western Uranium & Vanadium is offering up low-cost near-term uranium production to respond to this perfect storm of events, why is this not more accurately reflected in its share price?

The company's president and chief executive noted that while prices have substantially recovered for the majors, that renaissance has not yet extended to the juniors. He puts this down to a cautious mentality on the part of investors who are adopting a ‘wait and see' approach, having experienced false dawns before. Glasier is confident, however, that the unique value of the company he heads up will be recognised once it becomes established that this is a true recovery. Rob Klein echoed this sentiment: "We think the supply deficit is really going to accelerate over these next couple of years. We have supply that can hit that window", he said.

Glasier added that the company's value will also become clearer with the progression of the processing plant. This will afford the opportunity to communicate the economics of the project to the market and demonstrate how profitable Western Uranium & Vanadium will be.

Other factors that distinguish the company from the crowd include its kinetic separation patented process to upgrade uranium ore. With processing constituting the most expensive stage of production, Glasier recognises that savings here can have a dramatic impact. With kinetic separation taking the raw ore and reducing the quantity put through the plant by up to ten times, this will translate to what he described as "a substantial cost advantage over anyone else".

With a bio unrivalled in the uranium industry, George Glasier has seen it all. That he is more excited now about uranium's prospects than at any previous point in his career will be seen as significant by large parts of the commodity investor community.

ABOUT THIS COMPANY

Western Uranium & Vanadium Corp

Western Uranium & Vanadium is a near-term producer that acquired uranium and vanadium mineral assets in western Colorado and eastern Utah from Energy Fuels Inc. in August 2014 and acquired addition uranium properties and ablation technology through the acquisition of Black Range Minerals Limited in September 2015. The operational head office is located in Nucla, Colorado under the leadership of George Glasier, Founder, President and CEO.

HEAD OFFICE:

- 31161 Hwy 90 Road P.O. Box 825 Nucla, CO 81424 United States

- Phone: +1 (970) 864-2125

- Web: www.western-uranium.com

- Email: ir@western-uranium.com

SOCIAL MEDIA:

DIRECTORS

- George Glasier

- Bryan Murphy

- Andrew Wilder

- Robert Klein

- Michael Rutter

SHARES ON ISSUE

- 44.3 million