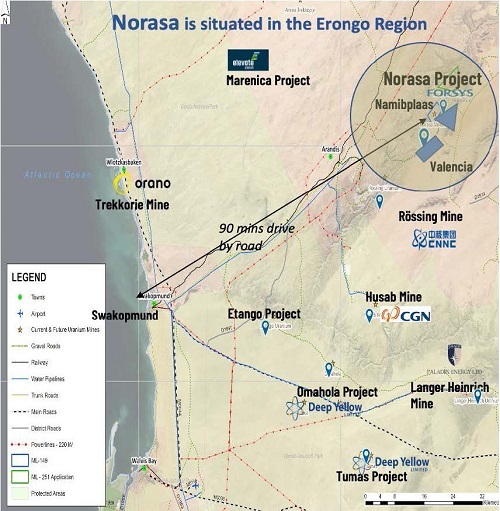

Forsys Metals Corp. is focused on uranium exploration and development in Namibia, southwest Africa, via its wholly owned Norasa project. This comprises of the Valencia and Namibplaas deposits, located in the country's Erongo region.

The company can point to 250 years of combined mining and capital markets experience. Headed up by chief executive, Mark Frewin, it is currently updating its

2015 Definitive Feasibility Study (DFS). Even back then, the study pointed to strong financials that would place Norasa squarely in the world's top ten uranium mines by size.

Once completed, it is anticipated the re-evaluation will reinforce the argument that Norasa's economics are unparalleled for any comparable project in the world offering up a new primary source of uranium production.

Forsys Metals is the type of company that only makes a noise when there's something worth shouting about. Like so many in the uranium space it was forced into a Fukushima-infused decade of care and maintenance. Yet thanks to nuclear's swift resurgence, it finds itself well positioned to respond to the sudden and increasingly ravenous appetite for uranium, which is built on solid foundations.

There are strong indicators to suggest uranium has truly broken free of its market shackles this time around, and that it will only be a matter of time before Forsys Metals' equity fortunes echo the surge in the spot price. The company is of the view the market is heating up and only set to get hotter.

The world's most populous nations are no longer able to turn a blind eye to nuclear's manifest problem-solving credentials. It is set to become not just de rigueur, but an essential ingredient in the clean energy mix needed to transition to net zero. Moreover, more nuclear reactors built on home ground offer up scope for enhanced energy security for western countries, such as the United States, justifiably sweating over such matters.

A vibrant nuclear energy sector in the US and Europe depends on a reliable supply of uranium. As such, a project like Forsys Metals', in a stable, democratic and foreign investment-friendly country like Namibia is considered manna from heaven. Especially so, when set against alternatives from jurisdictions replete with major geopolitical baggage.

In late 2021, Pine van Wyck was drafted in as country director to drive forward the Norasa project. Since that point it has been all systems go.

With an unrivalled uranium project development pedigree and a bulging contacts book built up over a quarter of a century, the Namibian native is considered a huge asset to the team. His serendipitous arrival has helped the company to rapidly adapt, pivot and scale up in response to a fast-evolving uranium market just when it needed to. A full calendar of news releases over the forthcoming months will pay testament to this, heralding a pipeline of catalysts sure to excite the market.

Van Wyck has assembled at Norasa a team of experts for the ages: metallurgists; geologists; permit, infrastructure, and process specialists et al - working in concert to optimise at every turn.

Part of the work he has overseen to date has established that the Norasa geology allows for heap, rather than tank leaching. This translates to lower capital investment and operating costs and fewer demands on energy and water, as will be testified to in a news release to follow. And with Norasa showing at the last count a total Proven and Probable Reserve of 206Mt at a grade of 200ppm, equating to 91Mlbs of U3O8, it transforms the naysayers' low-grade narrative into a compelling economic story. In addition, heap leaching comes with a big environmental win, since it uses far less sulfuric acid.

Specific CapEx and OpEx projections are just around the corner, once Forsys Metals' multidisciplinary team has concluded its trade-off study and struck on the optimum technical way forward. Once verified by external consultants SGS and DRA, results will be contained within another forthcoming news release.

As well as being able to point to high recovery rates and a fully permitted licence in respect of Valencia, the company believes the new DFS should act to add weight to the notion it is significantly undervalued. From the chief executive, Mark Frewin down, there exists a confidence that the updated data will make for such good reading it will act as a stimulant to investors, and see them enchanted by the logic of the Forsys Metals proposition.

Director of Investor Relations, Richard Parkhouse, whose connection with the company goes back well over a decade, is already witnessing first-hand the sharp uptick in interest from financiers and investors as they watch before them the Forsys Metals story "shifting into something more dynamic".

The company is also keen to draw the spotlight on the excellent relationship it enjoys with the Namibian authorities. According to the World Nuclear Association rankings, the country was the globe's third largest producer of uranium in 2022. And so, with mining a critical driver of the country's fortunes, its top policy- and decision-makers are keen to ‘make', not ‘break' projects. They are readily accessible, repudiate red tape where possible, and come armed with a ‘can-do' approach. This is a markedly different affair from some other tier one jurisdictions known for their over-zealous administration.

Forsys Metals is clear that new sources of primary production - like it envisages at Norasa - represent the only way the widening uranium supply demand divide can be bridged.

Namibia, a global uranium hotspot scoring strongly on the rule of law and security of tenure fronts affords the company the opportunity to take advantage of inherent African economies to increase its investment allure. Offering up low cost, large-scale, simple mining in one of Africa's most politically stable countries, completed upcoming milestones will see Forsys Metals even better positioned to advance along its development pathway. And as it inexorably advances, the day when it can answer the clarion call for more uranium to help feed the world's fast-growing fleet of reactors gets ever closer.

The forthcoming re-evaluated DFS is keenly awaited.

It would not take much of a shift from the 2015 measured and indicated resource numbers for Norasa to lay claim to largest permitted new uranium project in the world. At that juncture, one would not be surprised if the select body of investors currently beating a path to Forsys Metals' door for a piece of the action swiftly turned into a stampede.

ABOUT THIS COMPANY

Forsys Metals

Forsys Metals Corp. (TSX: FSY) and its subsidiary companies are engaged in the acquisition, exploration and development of mineral properties. The Company’s principal focus is on bringing its wholly owned Norasa Uranium Project (“Norasa”) into production. Norasa is the consolidation of the Valencia and Namibplaas Uranium Projects located in Namibia, Africa, a politically stable and mining friendly jurisdiction.

HEAD OFFICE

-

20 Adelaide Street East, Suite 200, Toronto, Ontario M5C 2T6

-

Email: info@forsysmetals.com

- Phone: +1 416 818-4035

MARKET CAPITALISATION (at 22nd November 2023)

- $152 million CAD