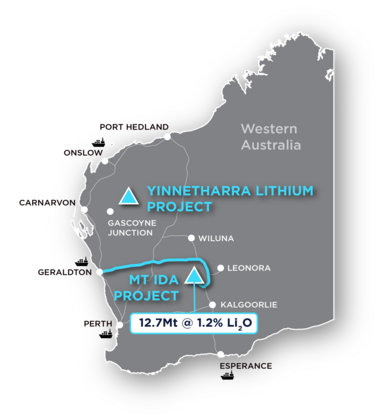

Mining approval is expected within the coming months for Mt Ida, Delta's 100%-owned project containing 12.7 million tonnes grading 1.2% lithium oxide about 100km north-west of Menzies.

"There is no one in the queue [for approval] behind or in front of us," Flanagan said.

"We have the next lithium mine in Western Australia."

The company is backed by a management team that's developed seven separate mining projects in the tier one jurisdiction in the past 15 years.

Flanagan is renowned for quickly leading explorer Atlas Iron into production in the Pilbara and taking the iron ore miner into the ASX Top 50.

Delta is certainly setting a cracking pace at Mt Ida, having acquired the previously-mined project in 2021 for its high-grade gold and copper.

The company, which changed name from Red Dirt Metals earlier this year, quickly confirmed Mt Ida's high-quality lithium and plans to get into production as soon as possible, starting by exporting a direct shipping ore product alongside developing a concentrate project.

There are already mining leases and heritage agreements in place and talks are underway regarding export from the Geraldton port.

Yinnetharra yielding world-class potential

While Mt Ida is Delta's frontrunner to production, Flanagan believes the company's earlier-stage Yinnetharra lithium project in the Gascoyne has world-class potential.

He said the geology at the two projects was quite different and outlined the difference in scale.

"At Mt Ida we see a handful of mineralised pegmatites, intersected in historical gold drilling, which have formed the basis of the existing resources [about 13Mt at 1.2%Li2O] and at the surface we see one pegmatite in outcrop, the size of a family dinner table," he said.

"At Yinnetharra, we have mapped somewhere approaching 80 pegmatites at surface which we believe are prospective from lithium and they are all substantially larger than the Mt Ida pegmatites, many are several hundred metres in length."

Delta Lithium's project locations

Delta has identified the Jamesons prospect at Yinnetharra, and Malinda which hosts a "lithium mile" comprising the M1 and M36 parallel ore zones both drilled over 1.6km in strike length and remaining open down plunge.

Recent drilling highlights from M36 include 29m at 1.5% Li2O from 203m, including 11m at 3%.

"I think the prospectivity of Yinnetharra is world class," Flanagan said.

He believed Mt Ida would deliver incremental resource growth over time but with such potential emerging at Yinnetharra after only about eight months of drilling, the earlier-stage project would be the focus of Delta's exploration spend in 2024.

High-performance culture

Flanagan said as with his experience at Atlas, it was all about developing a high-performance culture at Delta Lithium.

"When you incentivise all your staff properly, do the right thing in the community, build the right board, take good advice, make good strategic decisions around execution and financing and attract good people and shareholders and work very hard, things line up and the business runs beautifully," he said.

"We are getting great advice from super experienced lithium experts in every part of the supply chain and we are learning as much as possible from everyone who has come before us here in WA."

The state currently accounts for about 90% of the world's hard rock lithium supply.

Flanagan said culture was also very important for both Delta's staff and contractors.

"When times are good it helps us remain highly competitive in every aspect and run very fast," he said.

"When things get bumpy, that same culture delivers creativity and resilience which helps overcome any challenges that pop up."

"Brilliant deal"

Flanagan and Delta's management were backed in a recent deal with Idemitsu Australia, which invested about A$46.4 million to increase its shareholding to 15%.

Idemitsu, a global conglomerate aiming for carbon neutrality by 2050, believes Delta has "the most exciting pre-development lithium projects in Australia".

Drilling at Delta Lithium's Mt Ida project

The deal also included a change of control undertaking, with Idemitsu to vote in accordance with Delta's board, while Flanagan remains in his current role.

Flanagan described the deal as "brilliant", saying it was nice to have Idemitsu highlight its support for him but the deal was really about Delta's entire management team.

"I really think this is also about Jeremy Sinclair (COO), Charles Hughes (chief geologist) and Daniel Taylor (chief marketing officer) who were central in communicating our speed to market strategy," Flanagan said.

"Idemitsu want to maximise their exposure to lithium through Delta and they want to make it as clear as possible they are aligned with all shareholders and completely support the team.

"If there's a knock-out bid for the company that's in the interest of shareholders, they will either bid themselves or follow the board recommendation.

"You can't ask for more than that and I can't wait to see some more tangible opportunities out of the relationship."

Gold to add sparkle to Mt Ida's lithium

As for Mt Ida's original allure - its gold and copper mineralisation - Flanagan expected an updated resource "in due course" and said it was likely Delta would extract lodes of gold ore while also mining the lithium.

Mt Ida has a JORC 2004 resource comprising 318,000t at 13.8 grams per tonne gold for 141,000oz.

Results from drilling in 2022 included 7m at 15.3g/t gold and 0.5% copper from 125m.

"It is quite novel," Flanagan said of Mt Ida's gold.

"It will definitely not limit access to lithium ores or slow us down.

"We see it as an opportunity to offset costs and increase cashflows."

While the gold price has been strong so far this year, around the US$2,000 an ounce mark, lithium prices have fallen from last year's record highs.

Flanagan was unperturbed, saying the lithium market was wonderful and "behaving exactly as it should".

Delta Lithium executive chairman David Flanagan

He said the volatility and commentary, plus expressions of interest to partner and invest, were so intense.

"It is just so clear that this is a globally important mineral with an immature cost curve with so much opportunity for a company like Delta Lithium," he said.

"The cost curve is going to evolve and Australia and Western Australia is almost certainly going to hold the same influence as we do in iron ore."

Once the cost curve developed, he expected the long-term SC6 (6% Li2O spodumene concentrate) to settle around the marginal cost of production, with occasional short-term dips and spikes.

He noted a derivative market was also developing, which he expected to become important in the next two to five years.

Team work

Flanagan was keen to pay tribute to the team at Delta as the company prepares to become WA's next lithium miner but he also took the opportunity to praise the company-sponsored West Perth WAFLW team, which remained undefeated.

"They then went on to win the grand final," Flanagan said, before summing up Delta's keys to success.

"Our team is brilliant," he said.

"We have awesome shareholders like Idemitsu, Waratah Capital, Deutsche Rohstoff, Mineral Resources, Hancock Prospecting and thousands of mums and dads.

"We have two awesome projects, one about to get approval to mine, one looking big.

"And our exploration spend is amongst the most active in Australia, which means huge news flow."

ABOUT THIS COMPANY

Delta Lithium

Head Office Address:

Suite 4, 6 Centro Avenue, Subiaco WA 6008

Tel: +61 8 6109 0104

Email: info@deltalithium.com.au

Web: https://deltalithium.com.au/

Social:

Twitter https://twitter.com/deltalithium

LinkedIn https://www.linkedin.com/company/delta-lithium-limited/

Directors

David Flanagan, Tim Manners, James Croser, Nader El Sayed

Market Capitalisation (14/7/2023): A$477 million

Quoted shares on issue: 521 million

Major Shareholders

Idemitsu 15%

Waratah Capital 10.2%

Top 20 50.8%