The digestion of the company's latest news is bound to kick along its already robust share price.

However, in running up to these big announcements, Lindian's share price had risen rapidly from a few cents in July 2022 to 42c in mid-July 2023, when chief executive officer Alistair Stephens was interviewed.

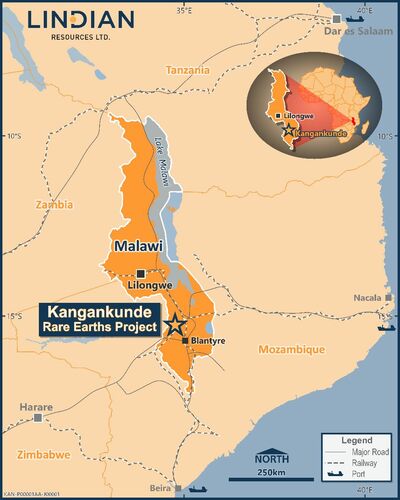

And it is not hard to be infected by his enthusiasm for rare earths and what the company's Kangankunde project, just 90km north of Blantyre in Malawi, could mean for not only shareholders, but potential end-users of the REEs Lindian will produce.

"Rare earths are particularly flavoursome at the moment, not just from the commodity market but also the regulatory market, the dynamics of the supply chain management and the importance of the products they go into. All of this makes rare earths topical commodities," Stephens said.

"At the time of the US$30M acquisition, I told our chairman that this was the deal of a lifetime, as I believe it is going to be one of the greatest rare earth project on earth. And it could be the biggest in the western World'."

And developed it certainly will, says Stephens, with Lindian determined to bring it into production as quickly as rationally possible.

Kangankunde is just 90km north of Malawi's commercial capital Blantyre, with easy access to the Mozambican ports of Beira and Nacala

"Civil works will start in the last quarter of this year [2023], with plant and major infrastructure into 2024. It is a small plant, mainly skid mounted. We hope to have commissioning by the last quarter of 2024 and producing by the first quarter of 2025."

The demonstration plant would target processing around 440,000tpa and, a head grade between 3% to 3.5%, producing 7,500 -10,000tpa REO.

Kangankunde has a mining licence and environmental certificates with water and explosives storage licences to be completed this year.

Kangankunde ticks multiple boxes in a wide range of spheres. The non-radioactive has an impressive recovery statistic to 70% to produce a 60% concentrate. Stephens is happy with this, but once in production improving recovery is the target.

Stephens believes it could be the first rare earths project to have a carbon-zero footprint.

While Kangankunde will initially run on diesel generation, the operation will transition to grid power as soon as practicable. And given that Malawi generates 95% of its power from hydro, this will set Kangankunde apart from its competitors in terms of carbon emissions.

"Gravity separation with water, eliminates chemicals, the product is non-radioactive and, in the future, we can do an electric mining fleet. We will build on this with sustainable community development projects, regenerating old-growth forests and assisting agricultural productivity programs. It flows into a beautiful ESG you could imagine for a mining project ꟷ and the only one on the globe in the rare earths space that could claim to have a genuine zero-carbon capable footprint."

Kangankunde's size and scale are evident, even though it is only targeting the high-grade central carbonatite in the upper 25% of what could be an even larger system.

Stephens says that the maiden resource estimation is based on phase-one resource definition drill results that go down to about 250m with several holes down to 300m.

"Two 1000m drill holes beneath the MRE will be sued to help validate the potential for an exploration target estimate below the mineral resource estimate.

Looking down on the mine layout at Lindian's Kangankunde REE project in Malawi

"Our MRE will probably contain a resource for a century of mining and the deep holes are there to assess that there could be multiples of centuries of mining, giving it real strategic importance in terms of the rare earths market.

"I anticipate the deep holes will be a ‘knock-your-socks-off' result," Stephens says, adding that the assays from the first hole are expected at the end of July and the second hole in September.

Stephens believes Lindian's Kangankunde Project is a Tier One resource.

"The magnitude of the MRE suggests that we could expand this project from an initial 10,000t, to many tens of thousands of total rare earth production."

"So not only is this project going to be a disruptor to the current supply chain dynamics, it is going an enabler of not just rare earths separation and refining, but of downstream magnets and electric motors manufacture. This giant of a resource will underpin these industrial developments," Stephens said.

When inaugurated in 2020 Malawian President Lazarus Chakwera made it clear that he was supportive of a robust mining industry in his country and referred to the three ‘ATM pillars' of the economy: agriculture, tourism and mining.

For both Lindian and Malawi's public purse, Kangankunde could indeed prove to be an ATM of wealth creation.

ABOUT THIS COMPANY

Lindian Resources

Lindian Resources (ASX:LIN) is an ASX-listed Australian company with world class rare earths and bauxite assets critical to EVs and a range of other industries including electronic infrastructure, solar panels, rechargeable batteries, wind turbines, medical imaging and manufacturing.

Head office address:

Level 24,

108 St Georges Terrace

Perth WA 6000

Australia

Telephone: + 61 8 6557 8838

Email: admin@lindianresources.com.au

Web: www.lindianresources.com.au

Directors and management:

- Asimwe Kabunga

- Alistair Stephens

- Trevor Matthews

- Jack Fazio

- Yves Occello

- Alwyn Vorster

- Park Wei

Market capitalisation (as of January 31, 2024):

A$155.5 million

Quoted shares on issue:

1.1 billion

Major shareholders:

Kabunga Holdings: 12.54%

Ven Capital: 9.97%

Rohan Patnaik: 7.47%

Topwei Two: 4.93%

Victor Lorusso: 4.75%

HSBC Custody Nominees 3.41%

BNP Paribas Nominees: 2.78%