Every single fuel tank will be replaced with a battery over the next 10 to 15 years. That will require a lot of lithium."

This is the view of Galan Lithium founder and managing director Juan Pablo Vargas de la Vega, better known in mining circles as ‘JP'.

JP was speaking to ResourceStocks just days after Galan announced outstanding initial well test results at the Hombre Muerto West (HMW) lithium project in the Western Basin of the Hombre Muerto salar in Argentina.

The eight-page announcement spelt out proof of recorded high lithium grades, porosity, and brine flow rates at the project in Catamarca Province, with tests forming an integral update on the long-term testing programme for HMW.

The full announcement can be found at https://bit.ly/3PgXV0b

JP, a mineral economist by profession, is the first to admit that life has had its ups and downs for him, noting that just six years ago he was working as an Uber driver in Australia.

He has been in and out of Australia over the past 20 years, but found his niche as a lithium analyst. This resulted in the establishment of Galan some four and a half years ago. Since then, he has spent at least half of his time in Argentina, building the teams working on the lithium developments there.

"Over the next six to nine months, we will be finalising our definitive feasibility study, and once that is done, we hope within three years to become the next Argentinian lithium producer," JP said.

"We stand by our promises, and, while we don't make much noise, we do get down and deliver the goods. We wouldn't promise anything that technically we could not do."

Because of this, JP is keen to attract investors who share his belief in what Galan is building in the lithium space.

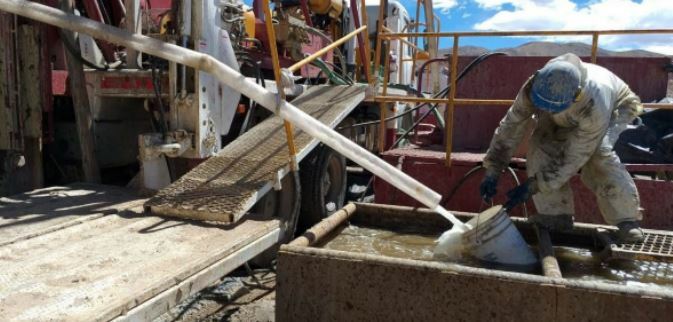

Brine flow testing at the HMW project

"I would like to attract investors who are happy to see us grow as we realise our value along the way. Ideally, we would like long-term investors, but, as we all know, there are many investors out there who have differing interests and investment horizons," JP said.

"Most of the value of the company will be realised when Galan becomes a producer over the next three years."

Unlike many other exploration and mining companies, Galan was largely able to avoid the negative outcomes of the COVID-19 pandemic.

"Before COVID hit, I was spending at least half of the year in Argentina and, as a result, when the pandemic arrived, my team in Argentina was well established and we were able to operate throughout COVID without problems," JP said.

"We even delivered a preliminary economic assessment (PEA) study while remote working, which is not possible unless you have a good team. And our team is getting bigger, stronger and better, and we are attracting people with lithium experience.

"We would like to think that Galan has three strong foundations on the back of the announcement we made in mid-July. The first of these is the excellent resource - high grade, low impurities, good flow rate and good porosity, which are all fundamentals for a lithium brine project.

"The second is that we have a very strong team of people with expertise in working in lithium brine operations, along with our board members who have worked in Argentina. They have all done this before and have a lot of experience.

"These are not West Perth ‘wannabes', they are people who have worked in lithium for many years. We have the people who can execute this, not just do a study and then wonder how they are going to do it.

"And third, we have money in the bank to do all the drilling, all the engineering and the studies to prove we can deliver a viable project economically, commercially and technically."

On the thorny subject of doing an offtake deal, JP is quite firm. "In terms of offtake, we have not signed anything with anyone as we want to do the right thing for the long term of the company," he said.

"Implicit in an offtake agreement is that the producer must discount pricing. So why would you clip your wings in pricing for the long term? If we did an offtake agreement, it would have to be with the right company."

Like many others in the lithium space, JP does not share the bearish view of the commodity articulated by Goldman Sachs in mid-June this year. The bank made headlines when it warned that a rally in lithium would go into reverse in 2022 as supply from unconventional new sources would come to overwhelm demand.

On site at Galan's HMW lithium project in Argentina

"I don't believe Goldman Sachs' point about supply was correct in relation to the lithium price for the next three years. I believe it will remain high. Very often, the fundamentals of lithium are not well understood," JP said.

JP believes the HMW project will be very competitive, as it is one of the cheapest projects on the market in terms of economics. "You have to have a low-cost base, and if the price of lithium comes down, we will still be there because we can compete," he said.

Apart from HMW, Galan also owns the Candelas project, a valley-filled channel, which project geophysics and drilling have indicated has the potential to host a substantial volume of brine and has a maiden resource estimated at 685,000 tonnes lithium carbonate equivalent (LCE). Candelas also has the potential to provide a substantial amount of processing water by treating its low-grade brines with reverse osmosis, without using surface river water from the Los Patos river.

Galan owns the Greenbushes South lithium project in Western Australia, just 15km south of Talison Lithium's Greenbushes mine.

"At Greenbushes South, we are advancing step by step. Because we are south of the Greenbushes mine, it is really interesting and could become exciting at some point. The geophysics we did in summer have given us targets, so we are going back in, writing them up, and seeing where we can drill. We need to have more than one target," JP said.

But for now, most of Galan Lithium's attention is on the projects in Argentina. Hombre Muerto is proven to host the highest grade and lowest impurity levels within Argentina, and Galan Lithium's next-door neighbours include Livent Corporation's El Fenix operation and Galaxy Resources and POSCO's Sal de Vida projects.

ABOUT THIS COMPANY

Galan Lithium Limited

Galan Lithium Ltd (Galan) is an Australian based international mining development company whose main focus is its lithium brine projects located in the Hombre Muerto Basin in Argentina

HEAD OFFICE

- Level 3, 30 Richardson Street West Perth WA 6005 Australia

- Phone: (08) 9322 6283 within Australia and +61 8 9322 6283 from overseas

- Email: admin@galanlithium.com.au

- Web: galanlithium.com.au

- Postal address: PO Box 396, West Perth WA 6872, Australia

- Fax: (08) 9322 6398 within Australia and +61 8 9322 6398 from overseas

- Australian Company Number (ACN): 149349646

- Listings: Australian Securities Exchange (ASX) Code: GLN; Frankfurt Stock Exchange (FSX) Code: 9CH

SOCIAL MEDIA

DIRECTORS

- Richard Homsany, non-executive director

- Juan Pablo (JP) Vargas de la Vega, MD

- Daniel Jimenez, non-executive

- Christopher Chalwell, non-executive

- Terry Gardiner, non-executive

- Raymond Liu, non-executive

Market capitalisation

- A$357.669 million

MAJOR SHAREHOLDERS

- BNP Paribas Noms, 19,923,957

- Raymond Liu and Assoc, 18,135,860

- Citicorp Nominees, 17,469,945

- JP Vargas de la Vega, 17,346,932

- HSBC Custody Nominees (Aust) A/c 2, 13,028,728