Coal is a commodity that garners scant public support at the moment, and with dwindling funding so exploration for the crucial ingredient of steel production has declined in recent years. Steel remains in high demand, however, and the pipeline of premium metallurgical (coking) coal deposits to service this sector has almost disappeared. No-where is this looming shortfall in the delivery of coking coal more apparent than the steel-producing centres of east Asia, and in particular China, Japan and South Korea.

Fortunately a near neighbour, Mongolia, has plentiful supplies of coking coal, and the country is expected to become a key global supplier. Step forward Aspire Mining Ltd.

Aspire was incorporated, as a shell company, in 2006. The assets in Mongolia were identified in 2009 with the help of Neil Lithgow, whose long experience includes work on coal and iron ore with Aquila Resources Ltd.

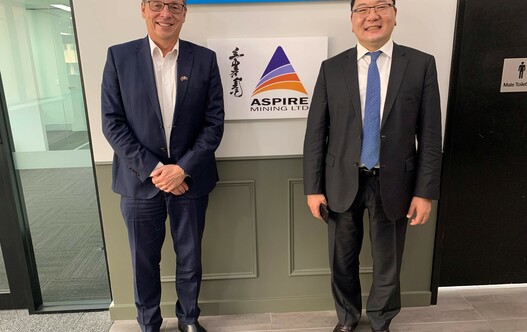

David Paull with the Mongolian Ambassador to Australia - Mr Davaasuren Damdinsuren

Aspire is now a large coal-tenement holder in the Orkhon-Selenge Coal Basin in northern Mongolia. Corporate assets there include two coking coal projects; a 100% stake in the world class Ovoot deposit and a 90% interest in the earlier stage Nuurstei deposit.

In December 2018, Aspire completed a A$10 million placement to major shareholder Mr Tserenpuntsag Tserendamba that increased his overall holding to 27.5%.

In October 2019, Aspire appointed Mongolian resident, and highly experienced coal-mining executive, Sam Bowles, to the role of Chief Operating Officer. Tasked with delivering the Ovoot project, the new COO is a mining engineer who has been in Mongolia for 12 years. Formerly country director for TerraCom Ltd (owner of the Baruun Noyon Uul coal operation), Bowles was previously COO for Mongolian Mining Corp.

The company received another significant boost two months later, in December 2019, when Tserenpuntsag invested a further A$33.5 million in Aspire's shares to acquire control, and agreed to provide additional funding support, including a corporate guarantee of A$100 million to support the Ovoot project.

A former judo champion, Tserenpuntsag is now a very successful Mongolian businessman and member of parliament, and a hugely respected figure in the country. As part of the deal to invest in Aspire, Tserenpuntsag's financial adviser Achit-Erdene Darambazar replaced David Paull as managing director two years ago.

Paull, who has 30 years of experience in resource business development and industrial minerals marketing, is now Aspire's non-executive chairman. He describes the Board's approval of Tserenpuntsag's takeover as strategic, and as an important part of the plans to make Aspire a more Mongolian company, and so boost the social licence to operate.

This view was echoed by BDO Corporate Finance, which was engaged by Aspire as the independent expert to express an opinion on Tserenpuntsag's investment. In its judgment, BDO opined that the advantages of Tserenpuntsag's investment were greater than the disadvantages. BDO's report was thorough and extensive, and laid out a compelling case for the Board to approve Tserenpuntsag's investment.

Ovoot Flagship

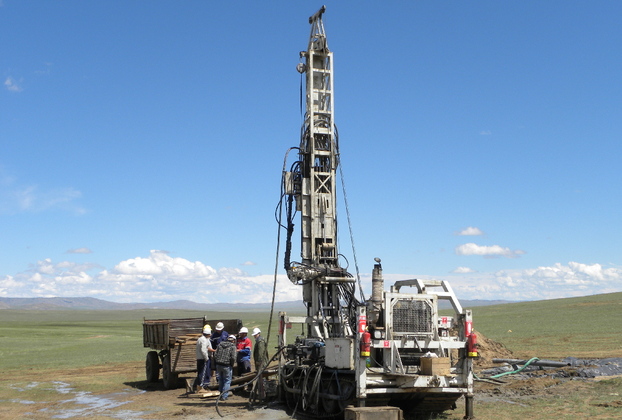

Aspire's Ovoot project comprises a mining license (granted in 2012 by the Mineral Resource Authority of Mongolia) The project's current JORC coal resources amount to 281Mt (over 70% in the measured category) with JORC coal reserves (in the probable category) totalling 255Mt (73% of which is marketable). Assessments to-date suggest that the project could sustain full-scale production of up to 10Mt/y of saleable coking coal from an open-pit operation with a long life, and with the possibility of an underground extension.

A pre-feasibility study (PFS) on an Ovoot 'Early Development Plan' (OEDP; completed in February 2019) outlined a 4Mt/y, nine-year truck/rail operation. The study calculated a 44% IRR (net of capital payback) and the potential to extend the mine life under truck/rail to over 12 years if required.

Aspire updated the PFS at the end of 2021. The revised study cut OEDP's up-front capital cost from US$47 million to US$31 million as a result of forecast lower mining costs and deferred capitalised waste removal. Updated mining contractor-quoted rates contributed to an 8% reduction in expected C1 cash costs to US$76/t of coking coal delivered to the Chinese border, and increased the pre-tax net present value (10% discount rate) on OEDP to US$878 million.

Aspire recently presented a Detailed Environmental Impact Assessment for the Ovoot mine to the local community, and is currently advancing a definitive feasibility study on OEDP. The latter will build on the PFS's 4Mt/y medium-term solution, with a proposed low strip ratio of 4.6:1 and payback in just two years.

The project is boosted by a relatively low ash deposit that beneficiates well, with no residual thermal fraction. The company plans to construct an on-site washery, with the results of a Front End Engineering and Design study having recently been released. This will be only the second such facility in Mongolia (the 20Mt/y being produced at Tavan Tolgoi is washed in China because of the shortage of water and washing facilities in the South Gobi).

The indicative washed coal specification includes 11% moisture, 10.5% ash, 25-28% volatiles and 1.2% sulphur, and the product is classified as 'Fat' under China's coking coal specification system. This coal category indicates a high fluidity coal, with good plastic and excess caking properties. As a result, the Ovoot product could be used to augment lower quality coking coals from elsewhere.

Coking coal prices have risen recently but, in evaluating its projects, Aspire tries to avoid the 'noise' of markets. Based on a ten-year history of prices, Aspire is basing its estimates on US$150/t coal (CFR China). The primary export route would be south-east to the China border at Erlian, via truck and rail, then onto a Chinese distribution centre at Jining.

During the period to end-December 2021, Aspire reported delays in advancing the Ovoot project because of Covid-19 but was able to complete Stage 1 of a study into the coal handling and preparation plant, and the completion of handling options for the Erdenet rail terminal.

Nuurstei Development

Aspire also holds a 90% interest in the early stage Nuurstei coking coal project. Early drilling of multiple coal seams along a 1.8km strike has already demonstrated a resource of almost 13Mt, with 4.8Mt in the indicated category and 8.1Mt inferred. In addition, a separate near surface coal deposit lies to the west of a major fault.

Nuurstei is located 160km east of the Ovoot project, and 10km from the Khuvsgul provincial capital of Moron. The latter was recently connected by a sealed road to the nearest rail head at Erdenet. This project will be considered in more detail once the Ovoot Coking Coal Project has advanced.

ABOUT THIS COMPANY

Aspire Mining

Aspire Mining Limited is an ASX listed (ASX: AKM) 100% metallurgical coal and rail company focused on developing world class premium coking coal deposits in Mongolia.

Head Office

- Add: Level 9, 190 St Georges Tce, Perth, Australia - 6000

- T: +61892874555

- E: info@aspiremininglimited.com

- W: https://aspiremininglimited.com/

Social links

Directors

- Chairman — David Paull

- Managing Director — Archit-Erdene Darambazar

- Non-Executive Directors:

— Boldbaatar Bat-Amgalan

— Neil Lithgow

— Hannah Badenach - Company Secretary — Phil Rundell

Ordinary shares

- 506 million

Leading shareholders

- Mr Tserenpuntsag 52.5%

- Noble Group 13.0%

There are no other substantial shareholders (above 5%)